Dramatic swings

in yields – keep a close eye on hedging strategies

Our viewpoint

23 March 2020

Interest rate and inflation expectations tend to be pension schemes’ largest risks, often far outweighing equity risk

We are currently living in very uncertain times. When news articles aren’t focussing on the global toilet paper hoarding crisis, we are seeing headlines being dominated by equity market crashes. This is understandable – intra-day moves of 10% in equity markets are becoming the norm! Comparisons with 2008 are a plenty.

However, from a pension scheme investment perspective, things have changed since 2008. In 2008, FTSE 100 pension schemes had over 50% of their assets invested in equities, on average. Now, this figure stands at less than 20%.

While it is still important that trustees and sponsors consider and address the impact of equity market volatility on their investment portfolios, the impact of interest rate and inflation volatility tends to have a far bigger impact on pension schemes. These risks impact 100% of the liabilities, whereas equities only influence around 20% of the assets.

Hedging strategies when markets move a lot (and we mean a lot!)

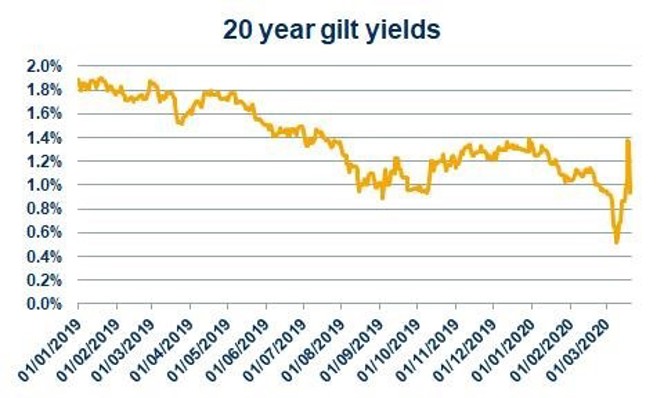

In the last couple of weeks, we’ve seen: the Bank of England cut interest rates twice; long-dated interest rates fell to all-time lows; then sharply bounced back to where they were at the end of 2019. By the time you’ve read this, things will probably have changed again.

While 1% moves may not sound as extreme as the equity market falls shown in the news, this 1% movement in long-term interest rates could actually cause a scheme’s technical provisions to change by more than 20%. So, we’ve seen values placed on liabilities go up 20% and then back down 20%! These moves have been even more extreme for accounting valuations, see this blog for more analysis.

We’ve also seen similar sized movements in inflation expectations. Although, at the time of writing, these moves have largely been in one direction: down. And it’s this move in inflation expectations which has caused the biggest difficulties for liability hedging strategies. Below we highlight three main reasons why:

- Most schemes have complicated inflation-linkages in their liabilities, but simple hedging strategies. For example, many schemes have RPI-linked pension increases with a “floor” of 0% and a “cap” of 5%. This pension increase is therefore fixed when inflation is above 5% (or below 0%) and inflation-linked when it’s in between. With the recent falls in long-term inflation expectations towards 2.5% pa, many pension schemes are now much more inflation-linked than when liability hedging mandates were set up.

- Some schemes have pension increases linked to CPI. These CPI increases are typically hedged with RPI-linked assets (such as index-linked gilts), with an allowance made for the difference between RPI and CPI (typically around 1% pa). However, the prospect of RPI being changed (“RPI Reform”) may now mean that the differences between RPI and CPI could be much smaller in the future and liability hedging mandates will need updating. You can see more about RPI reform in this blog

- Members retire early, transfer out and exercise benefit options; and funding assumptions (notably mortality assumptions) change – all of this feeds through to the inflation sensitivity of your liability measure. It will only feed through to your hedging mandate if you update it.

Don’t be surprised if your scheme’s inflation hedge is +/-20% (or more) away from its target if it hasn’t been updated for a while. I’d expect for most schemes, items 1 and 2 result in material under-hedging of inflation.

So what?

We recommend all trustees and sponsors review their hedging strategies to take account of the latest market conditions. We appreciate this is tricky in volatile markets, but we think changes can be made to better align with your risk preferences and ensure you are not shocked by further changes in market levels.

With everything else going on, it would be really frustrating if your hedge hasn’t been working as expected and it ends up costing you. (Particularly, when long-term inflation levels are close to all-time lows and governments are spending lots and lots of money which could all end up being inflationary.)

A review of your hedging strategy and setting new triggers could also help you make the most of volatile market conditions, locking in extra protection at good prices.

Finally, when reviewing your scheme’s hedging strategy, we recommend considering how efficient the hedge is. For example, have you got enough liquidity to withstand further large market moves, or more liquidity than you need and can afford to go hunting for attractive investment opportunities?

Unprecedented times in markets is creating unprecedented risks and opportunities for pension scheme protection – and now is the time to consider this in detail.