Corona crisis:

Some 31 March company balance sheets are going to be hit hard by pensions – what can be done?

Our viewpoint

19 March 2020

At this time of Covid-19 crisis, companies are facing a host of challenges to their businesses. Prioritisation will be key.

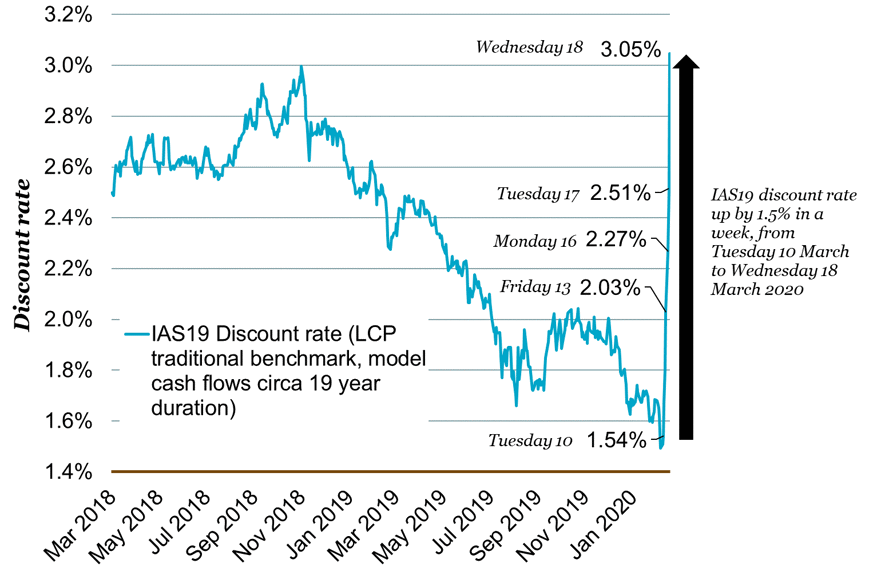

For many of those companies coming up to 31 March accounting dates, these challenges will be exacerbated by their pensions balance sheets and P&L. Recent market events, and ongoing volatility, mean the range of accounting approaches available for pensions warrants detailed consideration. The balance sheet figure is the difference between the market value of the assets and the assessed value of the liabilities – both of which have been hugely volatile due to the crisis and hence so has the net balance sheet position. The assessed pension liability for this purpose is driven by market yields on AA-rated corporate bonds – the lower the yield the higher the reported liability. These yields have been at an all-time low recently – but are bouncing around on a daily basis as the markets react to new information. This is shown by the chart below:

Based purely on these yield movements, the accounting value placed on an average DB pension liability will have moved around by over 30% in recent days and weeks! The uncertainty is compounded by inflation assumptions – market-implied long-term RPI inflation is currently running at around 70 basis points below its level a year ago (although this is probably due, at least in part, to the ongoing consultation on changes to the RPI itself).

The asset figure is equally volatile, although any hedging within the assets should act to mitigate the position. However, gains made on hedging instruments could easily be wiped out if a significant amount of equities are held – there has been a minus 24% total return on UK equities since last March, and overseas and emerging market equity returns are also in negative territory.

Putting the above together means there will be a wide range of situations relative to last year, and a significantly worse position for many.

Can you do anything about this? Yes, there are many actions that can help. To keep it simple, here are three actions that focus on an “accounting” perspective at 31 March (but do ask us if you are interested in the non-accounting strategic actions you can also take!)

Firstly, there is flexibility within the accounting standards regarding how to set the corporate bond discount rate assumption. As one example we’ve developed the LCP Treasury Model which addresses several issues with other common approaches and produces discount rates that are typically 0.2% pa above usual audit benchmarks (depending on scheme specifics). Whilst this may not seem like a big change, small increases in discount rates can significantly improve the overall pension accounting position.

Secondly, the inflation and pension increase assumptions are also important, volatile, and judgement based, compounded by the ongoing consultation on the reform of RPI. I’m therefore seeing a range of different approaches to inflation, with material consequences for the balance sheet. I’d even call some of these “innovative”, whilst also being in line with both the letter and the spirit of the accounting standards.

Thirdly, mortality assumptions seem to be an ever-moveable feast, as discussed on page 11 of our Accounting for Pensions report. Since that May 2019 report, there have been several important developments: the “CMI” publication in December casting new light on recent changes in longevity, the publication a few weeks ago of the latest annual improvement tables, and of course the onset and uncertainty around Covid-19. The issues here are even more judgemental, and span a material range of balance sheet outcomes.

Finally, I believe that accounting assumptions are going to play an increasingly important role more widely. That’s because the Pensions Regulator’s ongoing consultation on a radically new code of funding suggests that the technical provisions funding assumptions (other than discount rate) when taken together should be no weaker than “best estimate”(1). So it really makes sense to look in detail at all the assumptions now, not just the “main” ones that I’ve touched on here.

So in summary, current markets and volatility mean the range of company pensions accounting approaches warrants detailed consideration for many. Do get in touch if you’re interested to hear more about our tried and tested innovative methods for helping sponsors of DB schemes through these issues.

Note (1): Source Paragraph 243 of The Pensions Regulator’s Consultation document on the DB funding code of practice dated March 2020