Cracking the code:

unlocking member engagement in DC pensions

Our viewpoint

26 April 2024

Ensuring active engagement among pension members is an ongoing challenge faced by the industry, as we show in this blog as we delve into member interactions within master trusts.

Despite the crucial nature of pension savings in securing financial well-being during retirement, the era of auto-enrolment and default solutions has created a fresh challenge in capturing the attention of members.

Recognising the need to address this issue, schemes have been investing time and effort exploring ways to enhance member engagement. Many have focused on leveraging technology to deliver personalised communications and interactive tools that empower individuals to take a more proactive role in managing their retirement savings, while others have been focussing on broader financial wellbeing and looking at pension savings in this context.

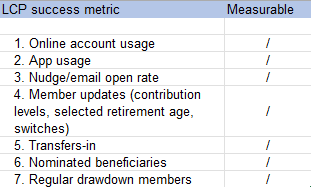

How can we measure successful engagement?

There are many ways this could be measured, but we have set out seven possible metrics that could be evidence of member engagement.

How are members interacting with their DC pensions?

In this blog we have focused on online account usage, app usage, nudge / email open rates and nominated beneficiaries.

Our analysis suggests that the percentage of online account users has remained static over the last two years. On average, around 16% of master trust members regularly log on to their online account. It may be that with the ever-increasing popularity of smart phones, over time, this percentage falls as app usage increases. However, there are material differences in this metric between the highest and lowest schemes. It is clear that, based on this metric, a substantial portion of members in schemes are disengaged or struggling to navigate their pension accounts.

The usage of pension apps presents a similar challenge. Despite the overall number of members who have ever accessed their account via an app being higher, on average, than website access only just 7% of members have logged in to their provider’s app regularly in the last two years. Member interactions increased throughout 2023, finishing the year at 10%, indicating a potential uptick in member interest as new features appear. It will be interesting to see if this trend accelerates.

Online account 16% average unique log ins 30% highest scoring master trust 2% lowest scoring master trust.

App 7% average app log ins 16% highest scoring master trust 2% lowest scoring master trust.

Nudges / emails 46% average email open rate 66% highest scoring master trust 36% lowest scoring master trust.

Nominated beneficiaries 15% average completion rate 31% highest scoring master trust 7% lowest scoring master trust.

While online engagement may face challenges, the nudge or email open rate tells a different story. From 39% in Q1 2022 to 53% in Q4 2023, the upward trajectory is encouraging. However, the challenge lies in converting these opens into meaningful actions.

The alarmingly low engagement score of 15% in nominating beneficiaries suggests a lack of attention to this crucial aspect of pension planning. Historically hindered by paper forms, and a lack of member understanding of the importance of nominations, the tide is turning with the advent of online and app based solutions.

In our experience, the difficulties outlined above are not exclusive to the master trusts. Across the board, the prevalence of low engagement levels remains a persistent challenge, but it also presents an opportunity.

Breaking down the barriers to engagement

In addition to provider-led communications, trustees and pensions managers could look at their own communications, to encourage members to act. A single tailored employer or trustee communication is likely to have more impact than a series of generic provider drafted communications. Sending them simple messages and tips, for example on how to use their account and make the most of the features they have access to, will rapidly increase awareness of the scheme. You could consider the use of incentives, such as rewards for registering online, or internal competitions to encourage employees to download the scheme’s app.

Most schemes now have the functionality to segment your membership to allow you to send them tailored and relevant nudge communications, alerting them members to upcoming online events, or useful tools for retirement planning.

Setting a targeted communications strategy with your provider can make a world of difference in ensuring that the right messages are being heard at the right time, while not overwhelming members with information.

By refining user experiences, promoting app usage, tailoring communication, and encouraging beneficiary nominations, actionable strategies can be deployed which should, paving pave the way for a more secure financial future for all. It's time to crack the code and unleash the full potential of DC pensions.