What do ‘higher for

longer’ interest rates mean for employer covenants?

Our viewpoint

11 December 2023

In November 2023, LCP’s Covenant & Financial Analysis team gave its insights on how trustees can protect their schemes where employers are feeling the strain from the current tough economic conditions.

In a follow up to Jon Wolff’s blog ‘Are many DB sponsors at tipping points?’, Robin Alexander drills into the current high interest rate environment, which is one of the key drivers for the issues many businesses are currently facing.

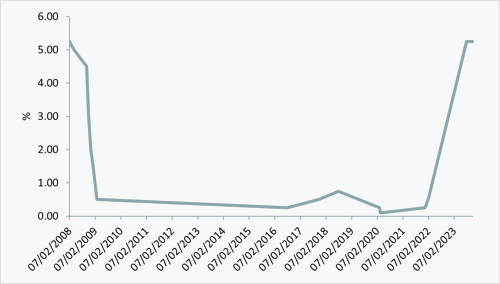

Interest rates in the UK are at their highest levels since 2008, with base rate now in excess of 5% pa. After nearly 14 years with base rate under 1% pa, some businesses had begun to take low financing costs for granted.

Bank of England base rate: February 2022 to August 2023

Source: Bank of England

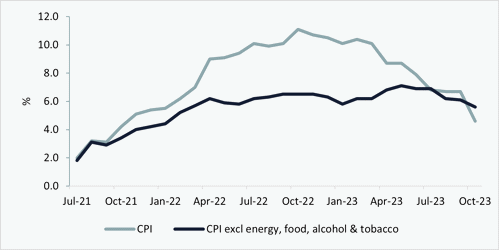

Although CPI inflation has fallen from a peak of 11.1% in October 2022 to 4.6% in October 2023, it is important to remember that the Bank of England’s target is still 2%. Likewise, core inflation, which removes more volatile constituents of CPI like energy, food, alcohol and tobacco (providing a better indicator of “underlying” inflation), has remained elevated across much of 2022 and 2023, and was 5.6% in October 2023.

CPI and CPI excluding energy, food & tobacco

Source: ONS

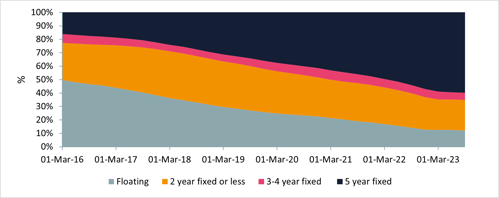

In combatting inflation, the Bank of England has raised interest rates to their highest levels in over a decade. However, the Bank’s key weapon against rising prices is somewhat blunted due to higher levels of outright home ownership and a greater prevalence of fixed rate mortgages. The below chart shows how fixed rate mortgages as a percentage of total mortgages has increased, with the majority (c60%) of all mortgages now being fixed for 5 years, compared to only 16% in 2016.

Distribution of outstanding mortgages held by type

Source: Bank of England

This creates a delay between rate setting and when the impact will be seen in the economy through lower disposable incomes. With inflation coming down, and the supply of money contracted (due to higher interest rates), there have been murmurings from some monetarists that the Bank of England’s approach could ultimately create a deflationary environment, which would present different challenges for businesses.

It will be interesting to see how the Bank deals with these challenges, but with base rates maintained at 5.25% for the previous two monetary policy committee (MPC) meetings, the mood music appears to be that it would be a riskier approach to start cutting rates now. As such we could well see interest rates remaining ‘higher for longer’.

What does this mean for your sponsor covenant?

Noting that every company is unique and will have different business drivers and debt structures, generally speaking the higher interest rate environment will result in negative indicators for covenant strength, eg creating demand pressures through lower disposable incomes and increased spending on debt servicing (where a business is highly leveraged and interest rates are not fixed / suitably hedged).

It is likely that elevated interest rates for a prolonged period of time will result in an increased number of businesses coming under some form of strain in servicing their debt. The knock-on effect of this is that many companies will have less cash available for strategic projects, capital expenditure, deficit repair contributions to pension schemes, and in extreme cases may result in the need for insolvency or restructuring processes.

As noted in our previous blog ‘Are many DB sponsors at tipping points?’, Q2 and Q3 2023 have seen the highest levels of company insolvencies since 2009. While there are also other macroeconomic factors contributing to the higher levels of insolvency, increased interest rates have almost certainly contributed.

However, funding positions have improved for many DB schemes as a result of increases in gilt yields. So as a counter to potentially weakened covenants, the period and quantum of covenant reliance may have reduced for many schemes.

How can trustees manage their risks?

Trustees should ensure that they have a solid understanding of how the business drivers, costs bases and debt structures of their sponsor could be impacted given a higher rate environment.

In particular regarding the debt structure, there are a number of critical matters to understand:

- The terms of the borrowing and cash flow impacts of changes to rates will help the Trustees to understand any upcoming liquidity pinch points.

- Whether increased interest rates or trading pressures could put banking covenants under pressure, which could give more control to lenders at the expense of other creditors.

- When the sponsor next needs to refinance, as this could be on notably more adverse terms (not only in terms of the cost of debt, but also with more restrictive banking covenants and / or the need for security to be provided).

The key to understanding these matters is built upon the strength of relationships with sponsors and ensuring a transparent flow of relevant financial information. In our experience information sharing protocols with employers (ie formally documented checklists of what information will be provided to Trustees and their covenant advisers, and when), are an important part of any scheme’s governance toolkit.

Preparation is key during periods of economic uncertainty. Trustees and sponsors need the right advice to ensure that they have the right plans in place for their pension schemes for when times are tough. LCP’s Covenant & Financial Analysis team have the right expertise and can help you plan for uncertainty.