Why LCP believes

exclusive sole insurer buy-in processes should be a voluntary choice rather than a forced inevitability

Our viewpoint

10 November 2023

LCP’s Charlie Finch explains why, despite a busy market, LCP believes all schemes, whatever their size, should expect to be able to run a competitive insurer buy-in process, if they wish, rather than accepting that an exclusive sole insurer process is their only realistic option.

This article originally appeared in Professional Pensions, click here.

I was intrigued by the article in Professional Pensions last month titled “Nearly one in three buy-ins and buyouts were exclusive in 2022” which suggested that “schemes of certain sizes should choose one insurer rather than approaching an auction process with several insurers, pointing out that competitive pricing can still happen in this process and could lead to better outcomes.”

This headline really jumped out as it suggested a “seller’s market” where schemes had to face a reality of a single insurer selection process with no competition. This contrasts with LCP’s experience, so I felt compelled to present the counterview.

Our consistent experience is that for schemes of all sizes it is entirely realistic to target multiple insurer participants. This is not to say that exclusive sole insurer processes aren’t in some circumstances the right answer (indeed some of our most successful processes have used this route), but schemes should not feel there is no choice.

Should smaller schemes run sole insurer processes?

The article implies that it is smaller schemes that are most likely to need to run exclusive sole insurer processes to successfully engage insurers. However, at LCP, we have continued to see strong competition from insurers at the smaller end, all the way down to smaller sub-£20m transactions.

Furthermore, the insurer pricing we have seen over 2022 and 2023 has been very attractive across the board and, even for smaller schemes, has compared favourably to the attractive pricing being achieved on larger transactions. This is despite a surge in quotation requests with double the number of smaller schemes approaching insurers over H1 2023 compared to a year earlier. This is discussed further in our recent report on supply and demand in the buy-in/out market.

I believe the secret to success in achieving competition for smaller schemes is how we efficiently bring insurers into the process using LCP’s streamlined buy-in/out service. This is a tried-and-tested process using pre-agreed contracts making it very straightforward to transact. In the last six months alone, the service has helped 10 schemes under c£100m successfully transact, with eight of the ten schemes attracting two or three insurers to compete.

Where does it make sense to run sole insurer processes?

Most of the cases where we have operated exclusive sole insurer processes have been larger schemes undertaking follow-on transactions with an incumbent insurer. For example, the logic might be to give the incumbent insurer a “first look” to see if its pricing continues to be as competitive as for the initial buy-in, with a view to then approaching the wider market if not. Sometimes there is a desire to have all members with the same insurer.

For schemes doing their first transaction, and regardless of the scheme size, a sole insurer process can also make sense in certain scenarios. For example, where there’s a wish to move quickly to lock-in favourable market movements or if the scheme has particularly complex benefits or requirements. Of course, the risk with a sole insurer approach is that the chosen insurer is ultimately not able to put forward a competitive proposal so it is important to have a plan for that scenario.

Perhaps the most high-profile example of a sole insurer process is the British Steel Pension Scheme where we were lead adviser on their “strategic partnership” with Legal & General which achieved full insurance across four transactions totalling £7.5bn. The scheme had complex requirements including robust protections for residual risks and the transfer of over £1bn of property. Legal & General was selected as a strategic partner for the scheme following an initial competitive process and a comprehensive agreement was put in place setting out the commitments the insurer was signing up to in return.

The changing market

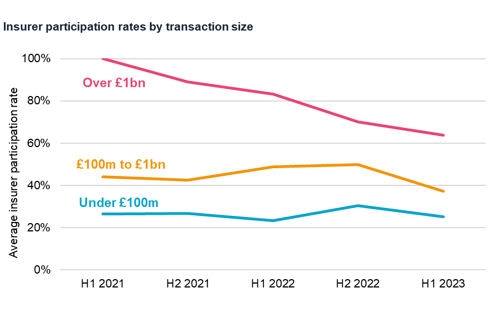

Taking a step back, there is no doubt that there has been a “seismic shift” in the market over the past year with the “balance of power” moving in favour of the insurers. The chart below – taken from LCP’s recent report – shows how typical insurer participation rates have fallen in different segments of the market.

Source: LCP survey of insurers

The overall industry average insurer participation rates fell sharply in H1 2023 on the back of soaring quotation requests, particularly above £100m, as insurers were forced to be more selective over which processes they participate in and which advisers they choose to work with.

In our experience, when insurers are “triaging” requests for quotations they will ask three key questions in deciding which cases to prioritise:

- Will the process be run efficiently?

- How likely is the deal to transact?

- Do we have a good shot at winning?

Offering to operate an exclusive sole insurer process will certainly help tick test 3) above but in our experience a well-presented scheme with a well-run process should be able to succeed in engaging multiple insurers in a competitive process. An experienced adviser who transacts regularly with multiple insurers will be able to help schemes present their transaction effectively to deliver this.

Conclusion

So, in conclusion, our experience is that schemes can access the market through a multi-insurer competitive process if they wish, whatever their size, and we believe that no scheme should feel compelled to run an exclusive sole insurer process to access the market.

The most important element of any process is having engaged insurers keen to direct their pricing firepower at your transaction, noting that insurers only have a finite supply of attractive assets to support competitive pricing. In general, having multiple insurers engaged at the right stages in the process will result in the best outcome but the optimal approach is always scheme-specific.

Our philosophy is to empower and work with schemes to run the right process for their circumstances, whether they are a small scheme, a corporate looking to fully insure or a Trustee with specific requirements like the British Steel Pension Scheme, and use our market experience to deliver the best pricing and terms whichever route is chosen.