How to prepare for your

pensions accounting year-end (and what everyone else is focussed on)

Our viewpoint

23 November 2023

In the ever-evolving landscape of accounting for pensions, preparation well before the year-end is critical. Recently we held a webinar on this subject, covering key topics such as treatment of surpluses and the new mortality era, to explore what that preparation should entail.

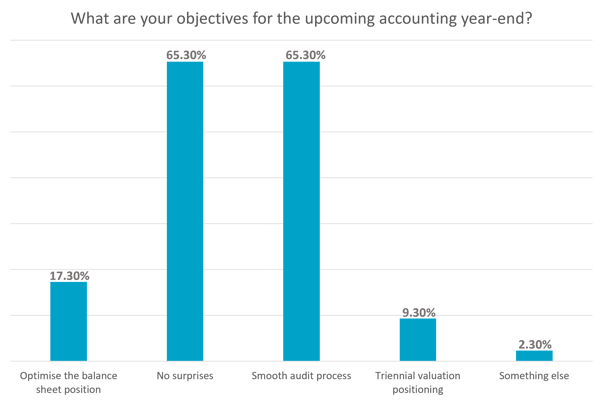

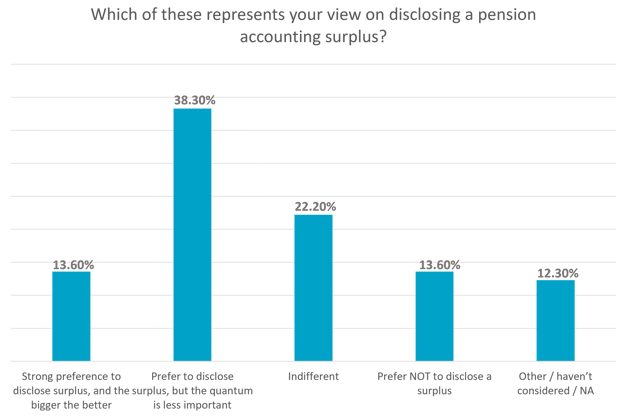

During the webinar we conducted two audience polls, probing into companies' objectives for the upcoming accounting year-end and their views on reporting balance sheet surpluses.

Ensuring a smooth audit process and avoiding surprises are by some way the most common goals for finance teams. The increasing auditor scrutiny many companies have seen in recent years means a greater need to prepare clear evidence to support both objective and judgemental assumptions and methods. And it’s not always enough to rely on what was done last year, as judgements made on advice provided several years ago (under very different conditions) can also be challenged.

While a sizeable minority (c 17%) still want to optimise the balance sheet position, this is now less of a priority for others as so many already have a surplus on the accounting measure. So what is their approach to reporting these surpluses on their balance sheets (noting the specific rules in UK and International accounting standards around whether this is a balance sheet asset, and if so how large)?

In respect of mortality assumptions, we discussed the ways in which the consequences of the Covid-19 pandemic and the actions taken in response to it continue to affect mortality rates, and how this is likely to progress into the future. Examples included the strain on NHS acute services shown by measures such as ambulance response times, and the longer-term consequences arising from disruption to the detection and treatment of chronic diseases. We discussed how the CMI (Continuous Mortality Investigation) has begun to reflect the impact of the pandemic in its model of mortality improvements, and how sponsors of pension schemes might parameterise the model to reflect the likely experience of their own membership.

So how to prepare for the year end?

First ensure your accounting objectives are clear, be they to minimise hassle and surprises, or perhaps to show a strong (and/or stable) balance sheet or income statement. Those objectives will then inform key processes, disclosures, assumptions and judgements. Amongst the key judgements are the future direct and indirect impacts of Covid, and these judgements need to be made in the face of a likely new mortality era that recognises both the uncertainties and the need for evidence and analysis that are geared to your individual pension scheme.