Who is running

master trusts?

Our viewpoint

14 July 2023

Whether the public is aware or not, master trusts are fast becoming the default home for many people’s defined contribution pension savings, with estimates that 25 million people already have more than £130bn invested in these schemes.

The importance of master trusts for the future retirements of the UK population cannot be doubted, so what do we know about the people responsible for these arrangements?

Each master trust has a trustee board (many are now fully independent of the provider or scheme funder) that is responsible for these schemes and holds a crucial role in managing and overseeing savers’ pots. It is safe to assume that as the amounts involved become increasingly huge, closer scrutiny is inevitable.

In this blog, we dive into the make-up of some of the largest master trust boards and uncover some interesting trends.

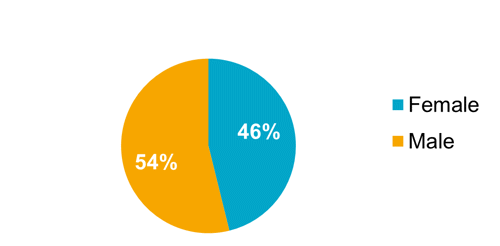

Gender, job done?

From our sample of larger master trusts, the trustee boards have almost gender parity, with female trustees making up almost 46% of the boards. This is just below the general UK population (51% female), but interestingly ahead of FTSE 350 company boards, where women represent only 40% of board roles in some of Britain’s biggest listed companies.

From our observations this parity has only been achieved relatively recently and it may be that a sample including smaller schemes would suggest further progress still to be made.

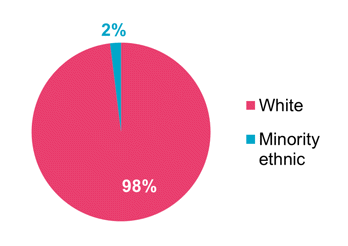

Ethnicity, work in progress?

The picture is much more one sided when we look at ethnicity. The vast majority of trustees are white, with only a 2% representation in our sample being from a minority ethnic background.

This compares starkly to a UK population made up of approximately 18% from minority ethnic groups. It seems we have more work to do in this area.

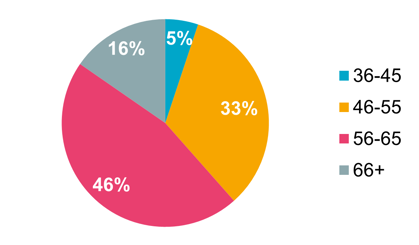

What about age?

When we look at the age profile of board members, just under two thirds are over age 55 (which is also the age at which DC members can currently start accessing their benefits). While a lifetime experience is clearly relevant in running these gigantic savings schemes, there can be benefits in bringing in fresh ideas and innovations that come with younger thinking and a Generation Z mindset. After all, many participants will be from this generation, and we think more boards could have value from this fresh mindset.

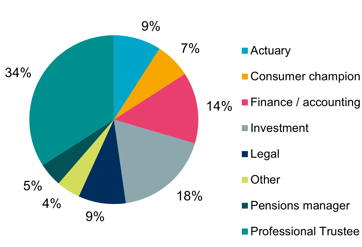

Where did they gain experience?

In terms of professional backgrounds, the trustees come from a variety of disciplines, including finance, law, investment, and actuarial work. This reflects the broad range of skills needed to manage a successful master trust. However, should schemes think wider than this and look to recruit from broader backgrounds still? Some schemes are going down this route, particularly given there are only so many industry professionals and there are already many overlaps across boards.

Final thoughts

As master trusts continue to grow, it will be interesting to see how these trends evolve and whether the boards become more diverse and include representation from broader backgrounds. One thing is for sure, nothing will stay still for long and as the stakes are increased, the pressure will only grow to challenge the status quo and we hope we’ll see future improvements in the makeup of these boards.