Negative

gilt yields – is it a game changer for pension schemes?

Our viewpoint

8 June 2020

On 20 May 2020 the DMO issued £3.8bn of three year nominal gilts with a yield of MINUS 0.003% pa. In the days that followed we had shorter-dated gilt yields fall further into negative territory.

We even saw 50 year interest rate swaps touch zero (i.e. to make money over the term of this contract you’d need the Bank of England to AVERAGE negative interest rates for the next FIFTY years).

I can’t be the only one who think this all sounds crazy.

But what does all this mean for pension schemes and are we entering into uncharted waters? What is interesting is that while the current climate appears new a lot of the implications aren’t. For instance:

- We’ve had negative real gilt yields for a decade and so many pension schemes already discount their liabilities with a negative rate (once allowing for inflation)

- Cash rates are already so low that once accounting for fees and costs the effective investment return on cash is already negative for some funds

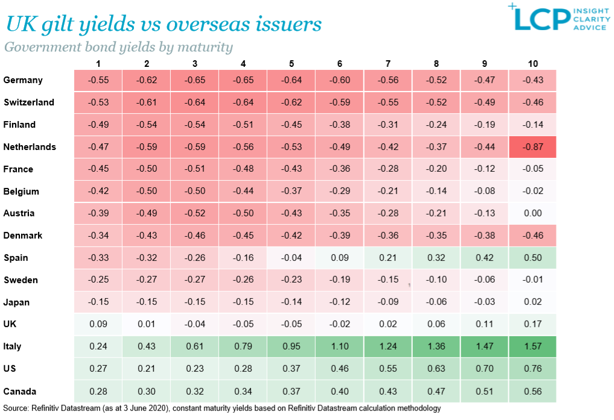

- Negative rates are nothing new for our European neighbours – in fact UK rates look a bargain compared to Swiss and German three year bonds yielding around negative 0.65% pa. The chart below compares UK gilt yields to other overseas issuers:

Furthermore, while there is a lot of fear around negative rates, there’s nothing mathematically wrong with using negative gilt yields in actuarial valuations and hedges will still work fine as yields turn negative. In fact whether gilt yields are -0.01% or +0.01% makes little difference to your average pension scheme (and even less difference if they’re well-hedged).

But are negative gilt yields a catalyst for re-examining views on gilt-based discount rates and re-testing strategies that hedge the price of gilts in the future? After all, if gilt yields are negative then schemes could just not buy them (and therefore not need to hedge the cost of buying them). Should schemes instead look to the yield on the actual investments that schemes own (or plan to own) and discount based on these investments? Why do gilts need to form part of any investment strategy if they’re so unattractively priced and guaranteeing a negative return? I have a lot of sympathy for these views.

But of course it isn’t that simple. What’s to stop yields on other investments falling in line with gilt yields? And what’s to stop yields on these other investments also going negative? Nothing stopped many European corporate bond yields going negative. And is any equity raise by a struggling corporate very different from a negative dividend? Hedging the price of gilts increasing, also provides a hedge against the price of other low-risk assets increasing too (albeit not a perfect one).

Should gilt prices increase significantly again (and it takes a brave person to say they definitely won’t) then it would be reasonable to assume insurer pricing (and scheme solvency positions) would follow suit to some extent. Setting funding and investment strategies that depart materially from insurer pricing may be a perfectly reasonable thing to do, but trustees and employers will need to be mindful of potential risks this adds to member benefits in an employer insolvency event and such risk should really be backed up by other protections (eg a strong covenant, contingent assets etc).

So, what does all this mean in practical terms?

- I won’t be rushing to buy any gilts in my own DC scheme

- If I was a DB member then I’d be very happy with a plan to guarantee my benefits with an insurer, and if that came at a negative yield then so be it

- If I was a sponsor and I hadn’t yet funded my scheme towards gilts-plus-a-little, then I’d be exploring whether there are alternative ways to provide security to members

I don’t think negative gilt yields are necessarily a game changer. But they’re certainly a great reality check on the investment and funding policies that schemes employ especially at a time when we are likely to see continued volatility in markets.