Future of RPI

– what does it mean for investments?

Our viewpoint

16 October 2019

A story that started with women’s clothing sales a decade ago, and a quirk of mathematics, could end with billions of pounds of value at stake, and cause hedging headaches for DB schemes – how?

Background

As set out in my colleague Jonathan Camfield’s blog, there is a strong possibility that RPI will be aligned to CPIH in 2030, or maybe even sooner. So how will this development impact on pension scheme investments?

So far, it appears there has been a relatively subdued market reaction to the 4 September announcements;

- The movements in prices of index-linked (ie RPI-linked) government bonds have fallen slightly relative to their fixed-interest counterparts although not much as you might have expected;

- The cost of hedging future RPI with inflation swaps has not changed as much as you might have expected;

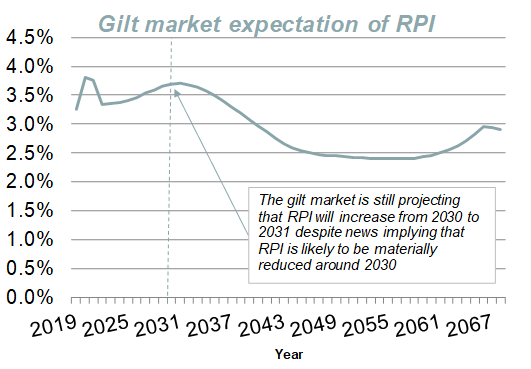

- The “market implied expectation” for RPI in 2031 is higher than the market price of RPI in 2029! (See chart below)

Source: Bloomberg as at 15 October 2019

On the face of it this is quite surprising as you might expect RPI to be around 1% pa lower if it is replaced with CPIH; this should in theory mean the market prices of index-linked gilts would move. The market movements observed are more proportionate to around a 0.2%-0.5% reduction in RPI. Jonathan’s blog dissects some of the possible reasons for the muted market reaction. Our view is that there is a reasonable chance (although not certainty) that the changes mooted by the UK Statistical Authority (“UKSA”) will take place and market pricing will at some point reflect this.

Schemes with RPI-linked liabilities

For schemes with RPI-linked liabilities who have hedged their inflation exposure, we expect many may continue to retain their hedges as impacts on assets and liabilities would be broadly “like-for-like”. An alternative that some schemes are considering is re-shaping their inflation hedges to focus on hedging exposures in the years prior to 2030, before this effect comes into play.

Schemes with CPI-linked liabilities

For schemes with CPI-linked liabilities, the decision is more nuanced. A standard approach has been to hedge CPI liabilities with RPI-linked assets, but these new developments challenge this approach. If the market subsequently corrects (as you might expect if RPI is aligned to CPIH) then the value of RPI-linked hedging assets could fall without a concurrent fall in their CPI-linked liabilities (as CPI would be unaffected). This would ultimately lead to increased deficits. This might lead to the conclusion that schemes should reduce (perhaps to zero) the inflation hedge for CPI exposure after 2030.

However, this exposes schemes to the risk of a general uptick in inflation and the market may take a long-time (if at all) to react to the UKSA announcement. Therefore, we advocate finding a balanced approach whereby post-2030 CPI-linked liabilities are partially hedged using RPI-linked assets. This helps to ensure that either a general uptick in inflation or market repricing of RPI do not totally blow a scheme off-course.

What does all this mean?

Most schemes have a mixture of RPI and CPI-linked liabilities. It is important to understand the exposure of your scheme liabilities to both inflation measures as well as the timing of the exposures. Further complexity comes with the impact of caps and floors on inflation-linked pension increases and “wedge” assumptions for CPI-linked liabilities.

Unfortunately, there are no easy answers to this issue. Compromises will be needed as it’s not possible to protect against all the risks at the same time. Each scheme will need to find the right balance based on its particular circumstances.