Auto-enrolment

contributions on the increase, but how much is enough?

Our viewpoint

9 April 2019

Following April’s rise in the minimum auto-enrolment contribution, Laura Myers takes stock of the policy’s success to date, and its prospects to boost pensions savings to sufficient levels in the future

There’s much to celebrate. According to the Government’s latest auto-enrolment evaluation report, 84% of eligible employees – some 17.7million people – are participating in a workplace pension, to the tune of more than £90 billion in 2017.

Those assets are set to swell now that the rise in minimum contribution levels from 5% to 8% of qualifying earnings has kicked in. Based on a median annual salary of just under £30k p.a., total contributions for the average worker will rise by just shy of £700 per year. But as we’ve argued before, even 8% in combined (employer and employee) contributions doesn’t go far enough if most people are to enjoy the standard of living in retirement that they expect. We believe that double that (around 16%) is closer to the mark.

Seeing the £s stack up

That’s the kind of stat that could drive even more ambitious pensions policy. It would see the total contributions paid in for the average worker boosted by a further £700 annually.

There’s a fine line to tread here. Increasing the auto-enrolment minimum will only work if Future Pensioners can see auto-enrolment as an important benefit accruing cash in the ‘bank’ (or pension fund) over time. If they see it as a ‘tax’ on their disposable income, then we run the risk that they will simply opt out.

Communication is vital. HR professionals have an important role to play in championing buy-in from employees, by helping them understand the value of their own contributions, and those of their employers. Trustees can do likewise by asking schemes to make this crystal clear in annual statements and other communications with members..

Compulsion with a caveat

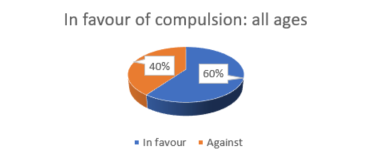

Hand-in-hand with higher contributions, greater compulsion is another option worth considering for policy-makers. Our recent YouGov research flagged up strong support for mandatory saving, with most respondents in favour of contributions being mandatory.

Compulsion should come with a caveat: Future Pensioners should be able to opt-down instead of opting-out. People are more likely to accept being compelled to save if they can retain the right to adjust payments should circumstances require it. The last thing we want for our Future Pensioners is that they are forced into debt in order to maintain contributions, therefore greater compulsion without a suitable “get-out” clause could risk alienating savers, instead of engaging them. And ultimately engagement, not coercion, remains the order of the day.

What’s the magic formula?

So what’s the magic formula? It would need to balance an array of competing needs, encourage greater buy-in and minimise the risk of opt-outs rising. That’s a tricky equation but not an impossible one. In our view, April’s increase to 8% total contributions should be a stepping stone along the way to reaching the ideal savings level, not the final answer. After that, perhaps 11% should be the next incremental step in policy calculations but, ultimately, we will need to go higher still.

Staged increases make sense to avoid major shocks to income levels that might make Future Pensioners shun saving altogether. But time is ticking. We can’t afford to take too long to reach the correct solution!