'One million fewer families

on Child Benefit since High Income charge introduced – urgent need to address state pension implications' – Steve Webb, LCP

Media centre

17 April 2024

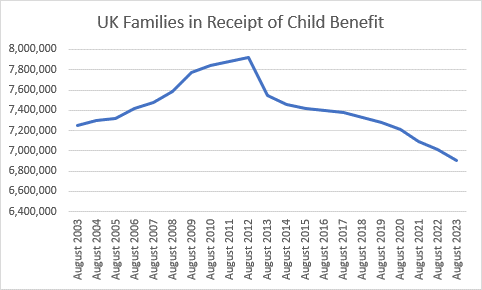

Figures published today by HMRC show that the number of families on Child Benefit peaked at 7.92m in the summer of 2012, just before the High Income Child Benefit Charge was introduced by George Osborne in January 2013. There was then an immediate slump of around 370,000 families claiming child benefits the next year, but the decline has continued every single year since then. The latest figures show that there are now just 6.91m families on Child Benefit, a fall of one million over the last decade.

Prior to the introduction of the charge, the number of families on Child Benefit had been rising each year, as shown in the Chart:

Source: HMRC

One particular problem caused by the drop in Child Benefit claims is the link to National Insurance credits for the state pension, available with respect to children under 12. If a family simply does not claim Child Benefit at all then the main carer misses out on valuable National Insurance credits. Just one year of missed credits could lead to a reduction of £329 per year in state pension or around £6,500 over a typical twenty-year retirement.

There is an existing option for families to claim National Insurance credits only, and not the cash benefit, but many families seem unaware of this option. In response, the government has promised to create a new type of National Insurance credit for families who, since 2013, could have claimed Child Benefit but did not do so. However, the necessary legislation has not yet been brought forward, and it is still not clear if families will be any more likely to be aware of (and claim) these new credits than they were to claim the ‘credits only’ option via the Child Benefit process.

Commenting, Steve Webb, partner at LCP, said: "These latest figures show the dramatic impact of the High Income Child Benefit Charge, knocking a million families off Child Benefit in just over a decade. An important knock-on effect is that hundreds of thousands of parents may have missed out on vital National Insurance credits towards their state pension. Although the government has proposed a new way of crediting people, we still lack important details, and there is a risk that these new credits will suffer from the same non-take-up problems we see in the existing system. This issue needs to be resolved as a matter of urgency.”