Record-breaking H1 2023 with over £20bn of buy-ins/outs now confirmed – LCP

Media centre

17 August 2023

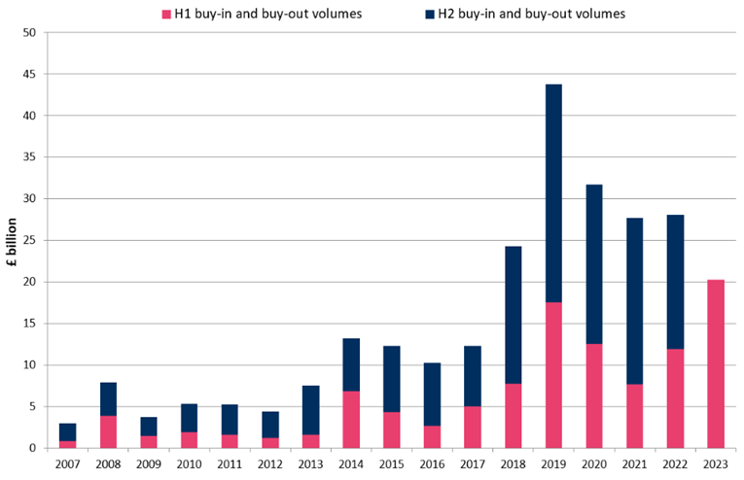

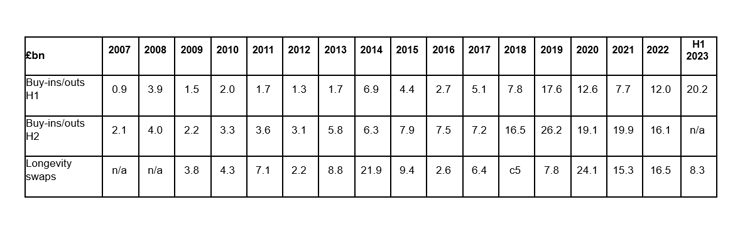

Following a flurry of insurer results this week, analysis* by Lane Clark & Peacock (LCP) reveals at least £20.2bn of buy-ins and buy-outs over the first half of 2023*. This represents the highest H1 volumes ever. With two insurers still yet to disclose final H1 results, volumes in H1 2023 are on track to be 20% higher than the previous record (2019: HY £17.6bn) and approaching double that seen last year (2022 HY: £12.0bn).

Full analysis is set out in the notes to editors section below, with key findings being:

- The record-breaking first half puts 2023 on track to break the record of £43.8bn of buy-ins/outs set in 2019. Volumes in the second half of the year have traditionally been larger than the first half, but final volumes will hinge on whether a number of big deals complete this year.

- The market has been dominated by large £1bn+ transactions, alongside a strong flow of smaller and mid-sized deals. So far six £1bn+ transactions have been announced – five in H1 and a sixth in early July – and we expect this trend to continue, putting 2023 on track to eclipse the record of 10 transactions over £1bn set in 2019.

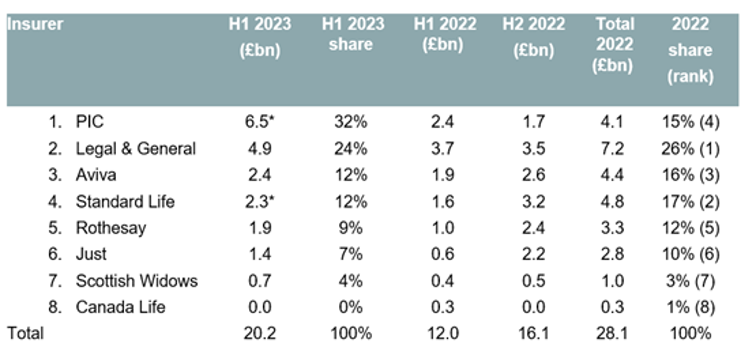

- The two biggest 2023 transactions to date have set their own records – the largest ever buy-in (£6.5bn) for RSA’s pension schemes with PIC, and the £2.7bn British Steel Pension Scheme transaction with Legal & General, which completed the insurance of this £7.5bn scheme – the largest full insurance of a UK pension scheme to date.

- Insurers have geared up to meet higher pension scheme demand, with six of the eight insurers having already written volumes significantly in excess of £1bn in the first six months of 2023. PIC is leading in terms of market share, followed by Legal & General, Aviva and Standard Life.

- Improved funding levels and attractive non-pensioner pricing have meant that schemes are increasingly able to move straight to full insurance, with the vast majority of transactions announced in H1 2023 being full scheme transactions. All eight active insurers are now writing full scheme deals – Canada Life announced their first deal, including non-pensioner members, in July 2023, followed shortly by a full buy-in with Roadchef.

- To date, in 2023, three longevity swaps have been announced, covering £8.3bn of liabilities (FY 2022: six longevity swaps totalling £16.5bn). These include a £5bn longevity swap between the BT Pension Scheme and Reinsurance Group of America announced in August, building on the £16bn of liabilities previously covered by a similar arrangement in 2014.

Imogen Cothay, Partner at LCP, commented: “Our report last October anticipated a big increase in demand for buy-ins/outs in 2023, and that is exactly what we have seen. The UK risk transfer market has never been so busy, with record-breaking volumes of over £20bn in the first half of the year. This is creating capacity crunches across the market, with insurers forced to be selective on which transaction opportunities to pursue. We carried out a major expansion of our specialist advisory team last year, giving us the capacity to manage multiple large transactions – such as the record-breaking deals for RSA and British Steel Pension Scheme earlier this year. It's this deep specialist support that schemes need to seize the best opportunities in this market..”

Ruth Ward, Principal at LCP, added: “In the near term, the spike in demand for buy-ins/outs, driven by rapid funding improvements for many schemes, is testing insurer capacities. Focussed and high-quality preparation and a clear journey plan have never been more important when approaching the market. Despite these pressures, it’s reassuring to see strong insurer engagement with no evidence of price hardening for the deals that we’re bringing to market.

“With so many deals over £1bn in the market, smaller and mid-sized schemes are having to adapt their approaches to maximise insurer engagement, making the best use of efficient and streamlined processes. LCP’s streamlined advisory process has already helped nine smaller schemes to achieve their de-risking goals this year and recently celebrated its 77th transaction.”

*Source: Insurance company data. LCP’s analysis is based on final reported results for H1 2023 from six of the eight insurers actively quoting in the market and publicly disclosed transactions over H1 completed by Pension Insurance Corporation (PIC) and Standard Life (the trading name for Phoenix Life), who are expected to release their full H1 2023 results in mid-September 2023.

Buy-in/ buy-out volumes in the UK by insurer:

Source: Insurance company data.*Standard Life and PIC volumes based on publicly disclosed transactions only. Only buy-ins and buy-outs with a UK pension scheme are included. The data therefore excludes the APP transactions by L&G (totalling £93m in 2022). Note the totals may not sum due to rounding

The chart and table below set out the volume of buy-ins and buy-outs each year since 2007.

Source: Insurance company data

Previous transaction data can be found in the appendix to LCP’s De-risking Report 2022, “Insurance enters a new phase: a skyrocketing market” available at: LCP transaction data 2022 (dynamics.com).

Link to the full report here: LCP pensions de-risking report 2022 (dynamics.com)