English football clubs lost over £1bn in 2021/2022 - with a huge reliance on owners to keep many clubs afloat

Media centre

13 July 2023

LCP has combined its finance and football expertise to release a first-of-its-kind report on the financial sustainability of men's football clubs in England, covering the 92 clubs in the top 4 divisions and introducing the new LCP Football Sustainability Matrix.

The report reveals a concerning pattern of consistent losses across many football clubs. Without significant cash injections, often from club owners, these clubs would unlikely be able to survive with the current levels of spending. When the future of a football club is in the hands of an individual or business, this presents a major risk to the club, its fans, and their local communities.

Many key players in the industry are calling for more oversight and regulation to address the systemic risks across the game. LCP’s report supports the need for change to limit the chances of more clubs falling into financial trouble.

To improve the financial state of many football clubs, LCP recommends a combination of increased financial transparency, more detailed due diligence on owner funding, and a system to incentivise and reward ‘good’ behaviour.

The overall picture

The depth of analysis has enabled LCP to draw out some clear trends in the industry, such as:

- The Premier League accounts for 85% of the industry’s revenue, with nearly half concentrated within the traditional “Big Six” clubs.

- Two-thirds of clubs are loss-making, with these clubs accumulating £1.2bn in losses in 2021-2022.

- £2.6 billion in debt is owed by clubs to their owners – this is debt that could be called in by owners if they wish or need to.

- There is a clear “gambling culture” for many clubs in the Championship, which is running by far the most financial risk. At an aggregate level, Championship clubs spent more on wages alone than they generated in revenue.

- There is a risk of systemic failure driven by many clubs owing significant sums to each other (typically transfer related), creating a potential “house of cards” financial collapse.

- Multi-club ownership is on the rise. This offers the potential for greater operational and sporting efficiencies across groups of clubs, but also a risk that smaller clubs in a group may become simply feeder clubs, or even deemed dispensable if not performing.

Commenting on the report, Senior Consultant at LCP John Parnis England said:

“To strive for a more financially sustainable football sector, as an industry, we need to address pressing issues, including the over-reliance on owner-funding. LCP has huge experience in assessing the financial support provided by employers to their pension schemes, and there are many similarities with football clubs and the financial support provided by their owners.

Our analysis shows that many clubs are heavily reliant on their owners to keep them afloat. This may be fine while owners are willing and capable of bearing the losses, but any change in the owner’s or club’s position (e.g. relegation) can quickly lead to significant issues arising. A holistic approach should be taken to anticipate owners’ willingness and ability to fund potential losses and future financial obligations.”

MP and Former Sports Minister Tracey Crouch (who chaired the recent Fan-led Review of Football Governance) said:

“Football holds great cultural significance in the UK, extending far beyond being just a game. It greatly impacts both the economy and local communities and is closely followed by fans and other key stakeholders who are deeply invested in its continued success.

LCP’s report offers new insights into the financial stability of English men’s clubs and how this relates to their on-pitch performance. The report provides a valuable contribution to understanding the current financial state of play of English football. I urge the industry to continue to embrace and reflect on relevant data and insights as we work towards encouraging more effective governance strategies within this important sporting sector.”

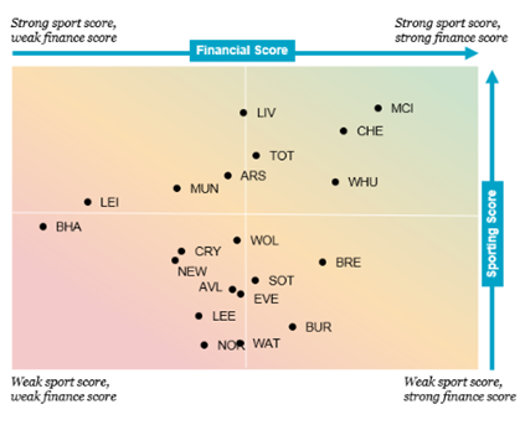

LCP’s Football Sustainability Matrix - Premier League 2021-22

The report also launches LCP’s innovative “LCP Football Sustainability Matrix”, assessing all 92 clubs based on both their financial performance, using a range of metrics, including the wage-to-revenue ratio and debt exposure, and their sporting achievements. Each club, and their fans, can view their own financial and sporting scores based on LCP’s bespoke methodology.

The table below shows the strongest and weakest clubs (from a financial score perspective) for the 2021-2022 season.

Notable highlights

- Plymouth Argyle’s financial score was the highest across the football pyramid in 2021-2022. This is mainly due to its strong balance sheet, high levels of cash holdings (almost a year of revenue), and impressive wage-to-revenue ratio. It was fascinating to see them also win the League One title, proving success can be achieved at lower levels of financial risk.

- Brighton & Hove Albion are highly regarded for the quality of their leadership, governance structures, talent development and on-pitch performances. However, LCP’s analysis does identify Brighton as an example of high level of reliance on the funding provided by a single owner, which is a potential risk to financial sustainability should the owner’s circumstances change.

- Reading FC, served a winding-up petition by HMRC in June 2023, had the second-worst financial score in 2020-21 and the worst financial score in 2021-22 of all Championship clubs, in LCP’s analysis. Had this type of analysis been taking place in a regulatory body with appropriate powers to encourage and assist clubs in rectifying financial problems, perhaps the issues the club is facing today could have been avoided.

- The change of ownership at Chelsea in 2022 hugely reduced the level of debt to its owners, as well as introduced a more diverse shareholding, which led to a significantly improved financial score. They had previously scored as the weakest club financially in 2020-2021, in part due to large outstanding loans to Roman Abramovich prior to the subsequent sale.

- Nottingham Forest and Bournemouth, who were in the Championship for the second season of this analysis in which they were promoted, both took on significant debt to support their successful push for Premier League promotion, potentially putting at risk the long-term financial sustainability of each club.

LCP's recommendations

To help address these issues, LCP is urging for the recommendations below to be considered as part of the government’s ongoing review of football governance, alongside the introduction of a new Independent Regulator of English Football (IREF):

- Transparency and consistency – all clubs should be required to publish basic financial and governance information in a timely manner and in a standardised format.

- Holistic risk assessment – a club’s finances need to be considered holistically alongside the position of its owners, both at the time of any acquisition and on a regular basis.

- Incentivise and reward – ‘Good behaviour’ should be rewarded by linking part of the distribution of broadcasting revenues to how each club performs in various key areas.

Summarising the recommendations, Bart Huby, Head of Football Analytics at LCP, said:

“Our report may paint a bleak picture of the current financial struggles faced by many English men’s football clubs outside the Premier League, but the government’s White Paper on Reforming Club Football Governance also provides a real opportunity to confront and overcome these challenges.

Better, timelier and more comprehensive information about the finances of clubs and their owners is vital to reducing the risk of clubs getting into difficulties. Furthermore, incentives and rewards generally encourage better practices, and we believe this could play a big role in enhancing football governance and sustainability. It’s high time we explore different solutions to work towards a brighter future for football.”