Contingent charging ban

already having ‘sizeable impact’ as DB transfer take-up plummets to lowest level in five years

Media centre

14 June 2021

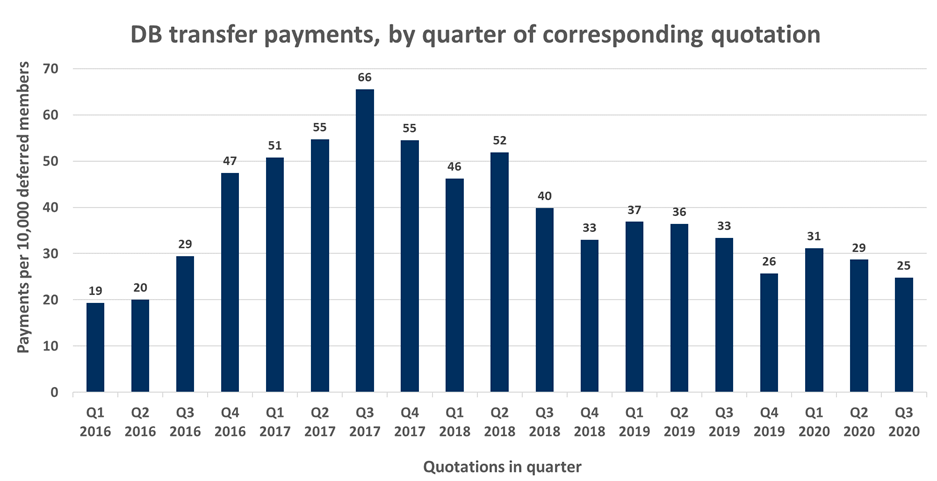

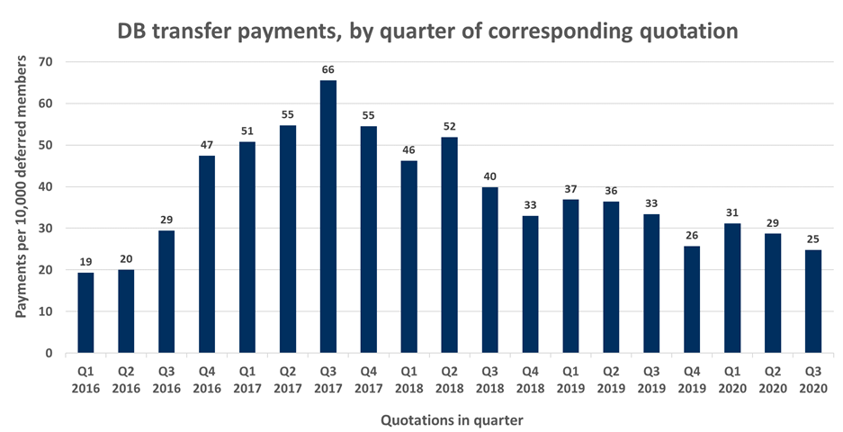

Analysis of the latest DB transfer data by LCP highlights that, for the latest complete quarter, just 25 out of every 10,000 (1 in 400) members transferred their DB pension into a DC arrangement, down 62% from the peak for the third quarter of 2017 (when 66 out of every 10,000 transferred) - and the lowest level since early 2016.

This fall was primarily due to a low take-up rate, with only 19% of quotations issued in the quarter being paid out – also the lowest figure since 2016.

Q3 2020 is the latest quarter with full transfer payment experience available due to the lag between a quotation being issued and the corresponding payment being made, which can be between 3 and 6 months.

While these figures are part of a long-term story of gradually falling transfer activity, LCP believe the latest drop seen can be directly linked to the ban on ‘contingent charging’ that took effect on 1 October 2020. The ban on advisers charging for advice based on whether a member decided to transfer was brought in due to fears that this fee structure could unduly incentivise advisers to recommend unsuitable transfers. This is however currently leading to significant market flux as some advisers switch to higher up-front advice fees to maintain profitability, while others may decide to leave the DB transfer advisory market altogether. This can make it increasingly hard for pension scheme members to find an adviser.

Other findings in the data include:

- Take-up rates for transfers under £500,000 dropped from 19% in the first half of 2020 to 13% in the third quarter of 2020. Increased up-front advisory costs are likely to have a particularly large impact on members with smaller benefits, as any fixed charges will appear large relative to the transfer value being considered.

- Conversely, the take-up rate actually increased from 40% to 49% for larger transfers, over £500,000.

- We may be seeing the beginning of a post Covid-19 rebound in the numbers of members wanting to consider a transfer - as the number of new transfer quotations is starting to edge back up towards pre-pandemic levels. There were 136 quotations per 10,000 deferred members issued in Q1 2021, an increase of 17% on the previous quarter and an increase of 22% compared with Q2 2020, when transfer activity dropped off sharply in the wake of the first lockdown.

- Data from LCP’s administration teams suggests that, after a slight drop around Easter, request activity has remained broadly at the same rate through April and May as that seen in Q1.

Commenting on the analysis, Bart Huby, Partner at LCP, commented:

“It’s clear that the ban on ‘no transfer, no fee’ arrangements is already having a significant impact on transfers. While this should be welcomed because it means that members are less at risk of potentially compromised advice, there is a danger that members may find the market too pricey and so not progress past the quotation stage. The fact that take-up rates for smaller transfers have decreased sharply in the last quarter is already indicating this may well be the case.”

Andrew Pijper, Associate Consultant at LCP, added:

“While the contingent charging ban is keeping transfer take-ups low, the green shoots of post pandemic recovery can be seen in the rise in the number of new transfer quotations. While it’s too early to say whether this increased activity will translate into more transfer payments, the indication is that more members are starting to plan for their financial future again as the pandemic recedes and life gradually returns to normal. Whether all these members will be able to access affordable advice is, however, another question.”