On point paper:

The PPF and Covid-19 – Can the lifeboat sail to calmer waters?

Media centre

27 August 2020

The PPF is a lifeboat for DB pension members. Where a scheme’s employer has become insolvent and there is still a large pensions deficit, it provides an important “insurance policy” to prevent much more significant reductions in retirement income, should the worst happen. With the long term economic impact of Covid-19 likely to be unprecedented, how could the PPF cope under the weight of many insolvencies?

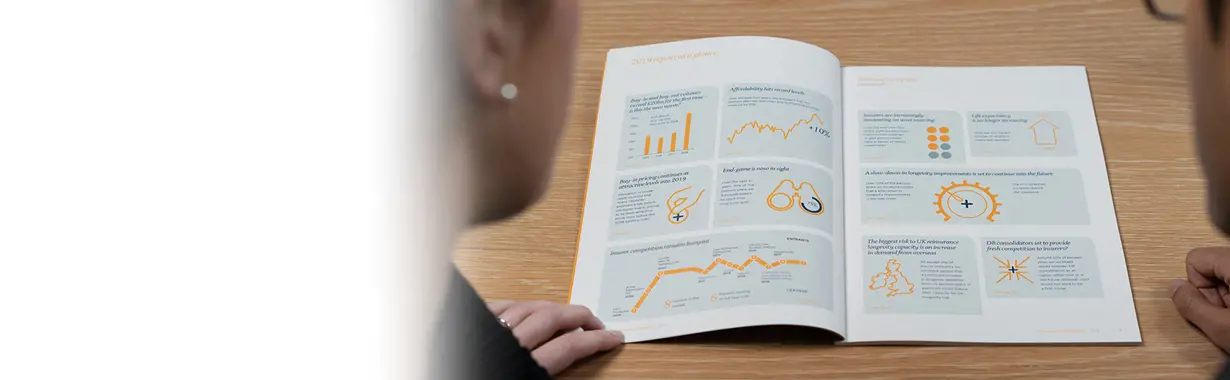

This paper looks at some potential scenarios, where the key risks lie and how the PPF has been affected in past downturns to analyse how they might navigate the impact of the pandemic. The paper has modelled two economic scenarios and the resulting financial hit on the PPF: one a £10bn hit and the other £20bn.

Key findings include:

- The PPF is likely to face a multi-billion pound hit as a result of insolvencies in the wake of the Covid-19 crisis

- It has several levers it can pull to deal with and absorb the large additional liabilities it may face including raising levies, changing investments and the nuclear option of reducing payments to members.

- Even in the more serious scenario of a £20bn hit, a combination of adjustments to the PPF’s funding strategy and self-sufficiency targets could be enough to cover the deterioration in funding without the need to cut benefits.