REFINE the steps

you plan to take

Our viewpoint

7 November 2022

We recently published LCP Gears - our Strategic Journey Planning Framework which sets out how we at LCP help our clients to achieve a successful journey to their ultimate goals, capturing opportunities and managing risks effectively on the way.

In this blog series we look at each step in turn, and what it means in practice.

The profile of your journey

In the previous edition of this blog series we set out the different components of a covenant underpin – affordability, longevity and resources. Under an integrated risk management approach, these components should then influence the profile of investment risks and returns that you choose to run. For example, if you have confidence in a sponsor’s ability to support the scheme adequately over the long term (“affordability” and “longevity”), you may feel comfortable de-risking gradually over time as the funding position of the scheme improves.

An alternative scenario is one where you believe that while the sponsor will be able to support the scheme in the near term, you have less conviction in the strength of their support in the long run eg if the industry they operate in is in structural decline (in practice this can mean just a few years from today). As a result, you may feel the best course of action involves running a greater level of risk today to aim to “get ahead” of where you need to be whilst you know the covenant will be there to support the risk, with a significant de-risking step then taking place to target a smooth, low-risk route to your destination in those latter years.

Setting your strategic asset allocation

Alongside the profile of your investment returns there are decisions to be made on how you plan to generate these which should be taken with an ultimate target in mind. These decisions include:

Hedging levels: it’s important to understand what you are trying to hedge and on what measure, and decide what is of greatest importance to you. Do you want to hedge based on the level of assets in the scheme, the liability value (and if so which) or something in between? Using LDI, which often includes an element of leverage, allows many schemes to hedge the full value of their liabilities. However, recent movements in the gilt market and the accompanying calls for additional collateral from LDI managers should prompt Trustees to closely consider what they intend their hedging strategy to achieve, and what risks this in turn will bring.

Illiquid assets: while we have a positive view of real assets and certain types of high-return credit from a risk and return perspective, a number of these asset classes are accessed through closed-ended or illiquid fund structures. This can result in assets being tied up for up to ten years (when factoring in fund extensions and / or gating) which is longer than many schemes’ expected timescales to reaching their ultimate objective, especially following recent improvements to funding positions. Schemes that reach their destination sooner than planned may have to accept a haircut to illiquid assets in order to complete a de-risking transaction, so careful thought is needed if planning a high allocation to illiquids.

Making effective use of buy-ins: entering into buy-in transactions allows schemes to reduce a number of risks when it is affordable to do so. Buy-ins can often generate returns in excess of those available on gilts, so are worth considering whether your ultimate objective is transactional (eg buyout) or long-term run off.

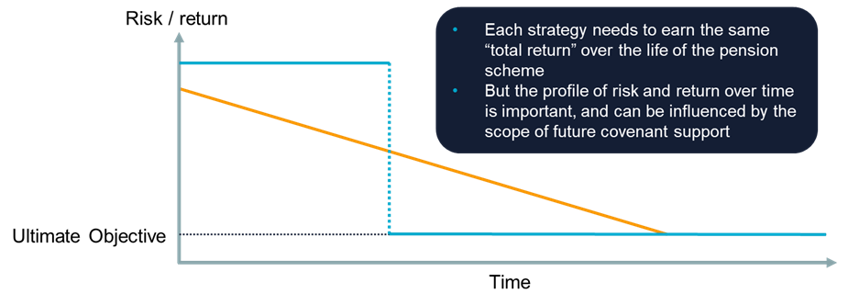

At LCP, we have developed a Strategic Portfolio that highlights the latest ideas from our strategy and research teams, and how these ideas can be brought together to build a complete asset portfolio. We also produce a low-dependency portfolio that we believe is appropriate for well-funded schemes and has been designed to provide flexibility to take advantage of buy-out opportunities. While not intended as a “one size fits all” strategy, you may wish to discuss with your consultant whether there are obvious areas of your existing portfolio that are not aligned with your destination.

The member experience

Another key part of your journey is membership experience – this can have a more significant impact in accelerating your journey to your ultimate destination than you might expect.

If you are setting the finer details of your plan, the odds are that your scheme is rapidly maturing. This means increasing numbers of members will be thinking about their retirement plans and options. Engaging on the membership experience can be a win on all fronts:

- a win for members if more support and options are available;

- a win for sponsors as take-up can see gains against long-term targets; and

- a win for trustees if a well-run, well-communicated exercise results in members welcoming greater flexibility or accessible financial advice, a reduction in risk, and a happy sponsor.

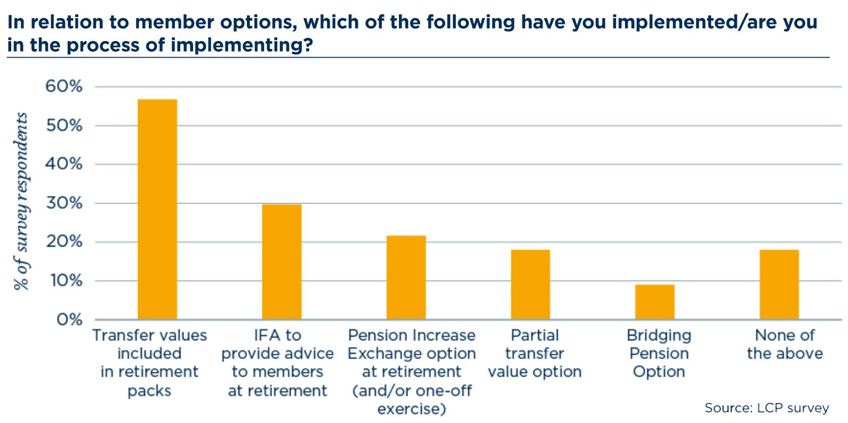

As shown in the above chart taken from our Chart your own course report, most schemes are now doing something on member options and retirement support. Members typically make their decisions months ahead of retiring. Our opinion is that the traditional “first contact” six months before retirement is not soon enough – members will have likely already made their retirement decisions, and may have benefited from being more informed, sooner.

Even small actions can have significant results. As an example, we helped one of our clients refresh their offering to members with a simple package including a funded IFA appointment, a review of member communications, and a new bridging pension option. To date the package has resulted in a c. £10m reduction in the estimated buy-out cost, with adviser fees and IFA costs a fraction of this. This has been a considerable component in reducing the timeline to reaching the ultimate objective from 5-10 years, to almost immediate.

i’s dotted, t’s crossed

There is every possibility that you may be pleasantly surprised to find yourself much further ahead of plan than you previously thought. It may therefore be worth considering actions now, that you might otherwise have left for later down the road. For example, making progress on preparing a benefit specification and getting it signed off by your legal adviser, identifying gaps in your data, or knowing when to collect marital data, can seem trivial, but could all help you avoid arriving early at the airport only to discover your passport is safely at home.

Our next blog explores these themes further and considers how to STEER your journey by monitoring progress and opportunities in real time, and making sure you are able to react to change.

Other blogs in the LCP GEARS series:

G - Is governance a part of your journey plan?

E - Have you established your ultimate objective and timescales?

A - Analyse what could change your journey

R - Refine the steps you plan to take