Analyse what could

change your journey

Our viewpoint

21 September 2022

We recently published our LCP GEARS Framework – setting out how we at LCP help our clients to achieve a successful journey to their ultimate goals, capturing opportunities and managing risks effectively on the way.

In this blog series we look at each step in turn, and what it means in practice.

As the past few years have shown us, the world is unpredictable, and things can change rapidly. Sponsor covenant is no different. Buy-out funding levels have improved recently for several reasons, but until all member benefits have been paid in full or a scheme completes a buy-out transaction with an insurer, there remains reliance on the employer covenant to underwrite risks that could materialise across the scheme’s journey, be they funding, investment, member related, or a combination of all three.

Understanding your covenant underpin

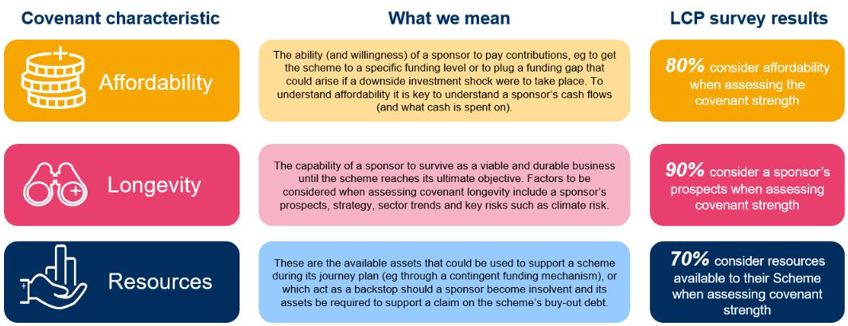

We think about the sponsor covenant from three key angles – affordability, longevity, and resources. Understanding the characteristics of your sponsor covenant from each of these three perspectives is the first place to start when considering what could change your journey. We’ve explained what we mean by each of these aspects below, and highlighted what respondents to our recent Chart your own course survey consider when assessing their sponsor covenant.

It is pleasing to see that many already consider all three aspects in their covenant assessment work.

Why is this important?

It’s key to understand each of these aspects of support that your scheme could rely on over its journey. Without understanding the cash potentially available to the scheme (affordability), the length of time the sponsor might be around (longevity) and the assets or contingent funding that might ultimately need to be accessed in extreme scenarios such as insolvency (resources) you can’t create a robust and holistic strategic plan. Most importantly you cannot identify how any changes in your sponsor’s circumstances might require you to rethink or adjust your existing strategy.

Although many sponsors have weathered the challenges of Covid-19, there are a number of macroeconomic headwinds impacting business across all sectors and, in some cases, triggering fundamental business change. This, in addition to the Russian invasion of Ukraine, supply chain challenges, record inflation levels, increasing interest rates and the global focus on the energy transition mean that the economic environment of three years ago looks very different.

Scanning the horizon for emerging risks

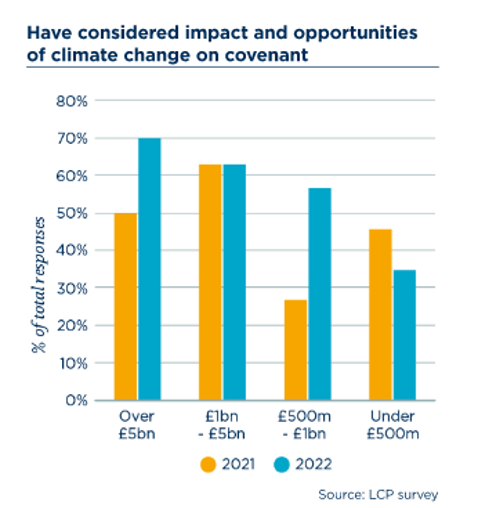

Our survey highlighted that climate change is moving up the priority list of many trustees and sponsors. The transition towards a greener economy is a highly complex and expensive challenge, and the emergence of climate risks, or capitalisation on climate opportunities, could have a substantial impact on covenant support available to a scheme over its journey.

Understanding how your sponsor is dealing with such challenges is a fundamental aspect of understanding risk, and ultimately the broader long term journey plan for your scheme. But schemes are not only exposed to climate risks from a covenant perspective. Climate change issues have a major impact on the broader macroeconomic environment, which can materially impact investment values and your funding position (and in turn increase your reliance on your covenant). Climate change can also impact on members’ life expectancies whether directly or indirectly and will need to be considered in more depth in the future as the climate pathway we are on becomes clearer.

At LCP we’ve worked hard to integrate climate risk into our thinking across the board, helping our clients to understand any concentrations of risk that exist between their covenant and journey plans. For example our integrated climate scenario analysis helps to understand when and to what extent climate risk may impact on a pension scheme’s assets and liabilities, through the lens of how the sponsor may fare. Applying an integrated view on how changes to funding levels and covenant can interact under different climate pathways and over different stages of a scheme’s journey is an effective tool in helping sponsors and trustees devise appropriate solutions to mitigate against climate risks.

What else can change your journey

Sponsor covenant underpins your journey so for many schemes it represents the biggest risk. As highlighted above, systemic risks like climate change are also rightly high on many agendas. But there are of course many other risks and opportunities that schemes need to understand and act on. We use tools like LCP Visualise to help our clients understand the key risks for them and their circumstances, enabling them to prioritise the time spent investigating and mitigating those risks as well as capturing opportunities.

Scenario analysis (as described above in respect of climate) can be a powerful tool: by understanding potential downside scenarios that may occur, trustees can test whether their existing investment strategy is optimal and put in place formal contingency plans to protect members' benefits if risks materialise.

Our next blog considers how to REFINE the steps you plan to take on your journey, to capture any opportunities that may present themselves and ensure that you are well placed to reach your goals.

Other blogs in the LCP GEARS series:

G - Is governance a part of your journey plan?

E - Have you established your ultimate objective and timescales?

A - Analyse what could change your journey

R - Refine the steps you plan to take