How to identify

the key issues early in reserving

Our viewpoint

2 May 2022

This article looks at how an analytical approach to reserving can help actuaries focus on what really matters, right at the start of the process.

We start simple and then tackle the limitations of the simple approach to build up to the full approach.

Doing reserving well can be hard. There are lot of things to consider and it can be difficult to know what to focus on. Or you only realise what you should have focused on too late in the process.

Some of the things that reserving actuaries have to consider are:

- What are the most material assumptions and method selections?

- Has the uncertainty in these selections been communicated?

- Have we been too anchored to existing assumptions and method selections?

- Should we have looked at a different reserving segmentation?

- Are our reserves a best estimate? How much margin is there?

With so many things to think about, it can be difficult to see the wood from the trees.

Analytical frameworks to reserving address this issue, and can be easily implemented into your reserving process by using platforms such as LCP InsurSight.

In the rest of this article we’ll go through the journey in building up to the full analytical framework and see how it addresses the limitations of existing approaches.

Starting simple

A simple approach is to calculate the reserves under different assumptions, method selections and reserving segmentations and see which of these make the biggest difference to the reserves.

This is typically already done at the end of most reserving processes, using a scenario analysis.

Such scenario analysis does add value to the reserving process, but has some weaknesses:

- it typically only covers a small subset of the possible methods and assumptions that could be considered;

- it tends to be anchored to the “best estimate” selections that have already been made; and

- because it is typically done at the end of the process, the findings are unlikely to affect the reserves until the next exercise, or may fall by the wayside in the interim.

Extending the simple approach

A better approach would be to perform this analysis at the start of the process, and to extend it to consider a much wider combination of assumptions, methods and segmentations, which aren’t anchored to the final selections. This will deliver greater insight and also leave time for the key findings to be incorporated in the final reserves.

However, a more exhaustive analysis like this will generate a lot of “noise” from assumptions or methods that clearly aren’t appropriate for a particular reserving class. For example, using a 1 year weighted average paid pattern to project every underwriting year on D&O business.

We need an objective way of filtering out the noise from these inappropriate assumptions and methods, so we can see the key issues.

Filtering out the noise

We can do this by back-testing each combination of assumptions (eg incurred all year weighted average DFM) and calculating a projection quality score for how well this projection performed at projecting past experience for a particular class.

We can then filter out the projections with poor projection quality scores, leaving just the better-quality projections for consideration.

This allowing us to focus on areas where there is the widest plausible range of reserves from using different methods and assumption.

What is a good quality projection?

The most obvious measure of projection quality is to project ultimates with data as at say 10 years ago, and then see how close the projected ultimates are to the final paid amounts on the current data, 10 years later.

However, this requires data over a very long time period and doesn’t capture how well the method and assumptions are responding to changes in recent experience.

We can address this by looking at how well a set of assumptions projects movements in claim amounts over a shorter time period, eg changes in incurred over a year. Using this ‘historical AvsE’ gives a measure of projection quality that requires less data and is more responsive to recent experience.

However, historical AvsE also has a limitation that it doesn’t work particularly well for classes with volatile claims experience.

We can overcome this by combining historical AvsE with a measure of how volatile the projected ultimates are between different back-test periods, which we call roll-forward volatility. This combined projection quality measure adapts well to different classes:

- For volatile classes, differences in projection quality are driven by differences in roll-forward volatility.

- For stable classes, differences in projection quality are driven by differences in historical AvsE.

This is taking too long

A final limitation to overcome is doing all of the calculations needed for this analytical approach in a reasonable timeframe.

For example, for an insurer with 40 reserving classes, covering 1,000 different combinations of selections for 3 back tests for each class requires 120,000 projections.

Running all of these projections in under an hour using commonly used tools in existing processes, like Excel, is not practical. It can be achieved by developing processes that use tools like R and Python within cloud computing services that are designed to deal with large amounts of data at low cost. However, developing these processes can require significant amounts of work.

The final solution

What is needed is an analytics platform that can handle the various analyses described above, at scale, and without requiring bespoke coding. I and my colleagues have developed such a platform for our clients, known as LCP InsurSight. Using our platform:

- We can take a firm’s reserving data and automatically sets up everything needed for a comprehensive analysis of possible reserving methods and assumptions.

- The platform automatically generates reserves and projection quality scores for every reserving class for thousands of assumption combinations, typically in under an hour, using a cloud computing environment.

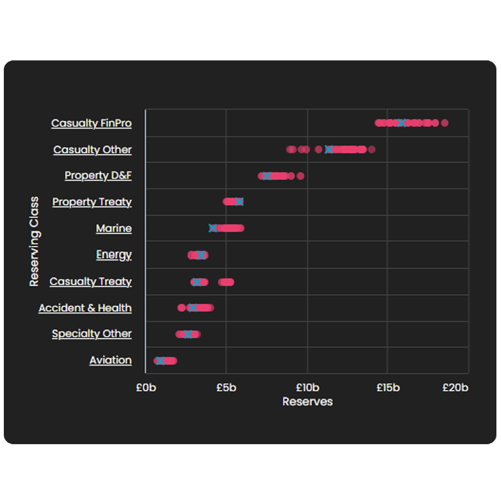

- The algorithm automatically selects good assumptions for each reserving class and identifies the most material assumption, method selections and segmentations to focus on.

- The reserving team can then refine and adjust the initial assumption selections within a controlled environment.

Conclusion

By applying an analytical framework to reserving we can identify and focus on the key issues right at the start of the process. Platforms such as LCP Insursight can implement this framework with the necessary scalability and without requiring specialist development work.

Overall, this means less time is wasted on unimportant issues and we have more time to focus on what matters.

As published in The Actuarial Post. Original article here.