Getting better value

from Actuarial Function opinions – Part 4

Our viewpoint

5 November 2021

My previous blogs set out three principles that should underlie the actuarial function opinions:

- Target value-add, not just compliance

- Actuarial function activities should occur before decisions are made

- Achieving best practice may be an iterative process

In this blog, I look at the reinsurance opinion. Previous instalments covered technical provisions and the underwriting opinion.

The importance of high-quality reporting

For many insurance companies, reinsurance is a critical business decision not just in terms of the amount spent, but also because of its direct effect on managing the risks of the business.

However, reinsurance is not a perfect science and there may well be several solutions that fit within the theoretical risk appetite. Essentially reinsurance purchase is an optimisation problem and the board needs to weigh up the appropriate factors in making its decision. The key to this is that the board must therefore have sufficient information to understand the financial dynamics of the different solutions being considered. The actuarial team will inevitably do a large amount of modelling to support its reinsurance recommendations, but the eventual insurance purchase decision is likely to be a commercial compromise.

The reinsurance opinion typically follows after the main reinsurance purchase decisions have been made. It is an opportunity to independently assess the quality of MI provided, and look at the decision from a different angle. One weakness that we often see highlighted by reinsurance opinions is that, while there is inevitably a wealth of qualitative information provided to the board, the quantitative information is not detailed enough to help the board to make an appropriately informed decision. I set out some ideas below to help the reinsurance opinion add more value to the business.

Using the right metrics

A good starting point is the simple question: “Is this year’s renewal better or worse value than last year?”. This information can usually be conveyed well by designing metrics related to the risk appetite or reinsurance policy and ranking the reinsurance purchased against these, compared to last year.

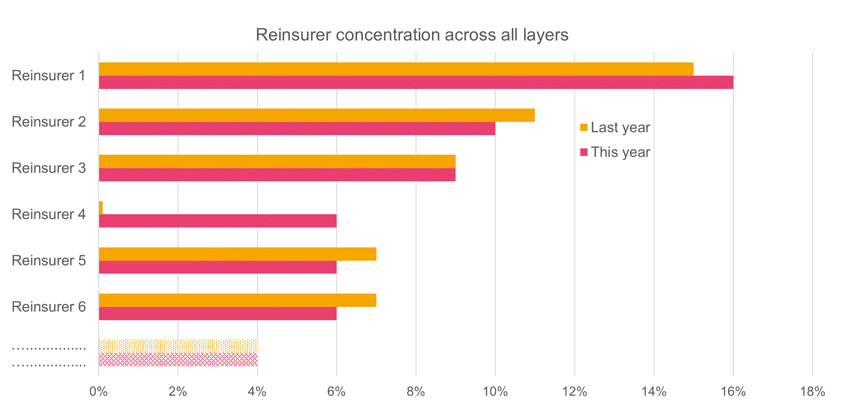

For example, the reinsurance policy may state that no single reinsurer should have more than 20% of any layer. While it is normally very clear whether this technical limit has been breached, it can be instructive to look at the entire programme, and directors can often be surprised at the level of reliance on a single insurer.

Sometimes in doing this, it becomes clear that the policy has not been expressed as clearly as it could be. This is then a good time to consider the detail of the risk appetite and whether it can be improved, which would then improve the reinsurance purchase decision process.

Another technique that works well is to supplement output from actuarial modelling with tests against historical experience – everyone on the board will remember vividly the company’s worst recent year and will want to know how the reinsurance programme would have responded to those losses. It is important to clearly articulate any differences now to then, eg if your line sizes have changed, or the terms & conditions have better exclusions, to help boards understand how relevant those losses were to today’s exposures.

And don’t forget to state the obvious. For example: “This programme leaves us exposed to a third post $10m loss, but the modelled probability of such a scenario is very low and/or in the history of the company there has only ever been one loss over $7m in a single year”. Often what is obvious to one person is not obvious to someone else, or it can be forgotten among the myriad other factors that need to be considered.

Another important area for the opinion is governance of the information supplied and communication of limitations. For example, if technical data for the reinsurance modelling was based on a capital model, typically the model is calibrated to the 1 in 200 level as it is mainly used for setting capital. This means that it may be less reliable at the 1 in 10 or 1 in 20 levels typically considered for reinsurance purchase. The reinsurance opinion should comment on whether such limitations have been communicated to the board so that they understand the implications of placing reliance on the model.

Feedback loops

Particularly because the reinsurance opinion is produced after the event, it is important to feed back any gaps in the technical analysis, or any additional analysis that the board has found useful. This can then improve the information gathering and analysis so that MI can be improved year on year, allowing the board to make more robust decisions. This underlies our third principle above: “achieving best practice may be an iterative process”.

In summary, some straightforward approaches can enable the actuary to use the reinsurance opinion to add value to the business:

- Make sure the board has the good quality MI it needs to make an informed decision

- Use simple well-designed metrics that answer the questions the board is bound to ask

- Don’t forget to state the obvious

My next blog will be the final one in this series, considering the actuarial function’s contribution to risk management, as well as bringing all the ideas together that we have been discussing.