Budget 2021

insights for the Entertainment, Travel and Hospitality Sector

Our viewpoint

10 March 2021

The Chancellor’s Budget announcement focused heavily on support for the entertainment, travel and hospitality sector, but will it be enough and who is being left behind?

In his speech, the Chancellor highlighted the importance of this sector, noting that there are 150,000 businesses supporting 2.4 million jobs across the UK.

The Budget announcement offers some immediate financial support in the form of direct funding and grants to help businesses re-open, and we also see a number of additional measures focused on ensuring the recovery and longevity of the industries.

Our key takeaways for the Sector

- A drive to reopen business in the sector, with restart grants and additional direct funding, including funds for museums, theatres and galleries

- Extension of furlough scheme and business rates holiday will be beneficial for businesses in the sector still unable to trade at normal levels

- Measures to help boost demand for hospitality, including the extension of reduced 5% VAT for hospitality and the freezing of alcohol duties

- Effort to save socially and culturally significant leisure and hospitality businesses at risk of failure through the new Community Ownership Fund

- A focus on culture and the arts, with a further boost to the Culture Recovery Fund and allocation for community cultural projects

- Increased traineeship and apprenticeship incentives, supporting future growth in the sector

- The introduction of Freeports will hopefully drive demand and new business particularly in this sector with hospitality, arts and culture all essential presence on any high street.

- Additional funding for sports and leisure will be a boost to professional and grassroots sport

On the flip side:

Despite all the support announced, we must remember that this is in the context of unprecedented economic turmoil which will have a long-term impact on the economy.

Restart grants for the industry are a positive move, but how far will they go? Media reports on the latest RICS benchmarking survey from 2017 put the average pub rent in the UK at around £37,000 per year, with the average in London at around £87,000, compared to the maximum grants offered of £18,000. Even once trade resumes, with high expenses and upkeep of Covid-secure environments, it may be a long while before these businesses start seeing sustainable profits. Cash will be welcomed to facilitate start-up, but ongoing cashflow pressures will remain.

LCP’s Financial Wellbeing Report for employees working in arts, entertainment and recreation (including hospitality), February 2021

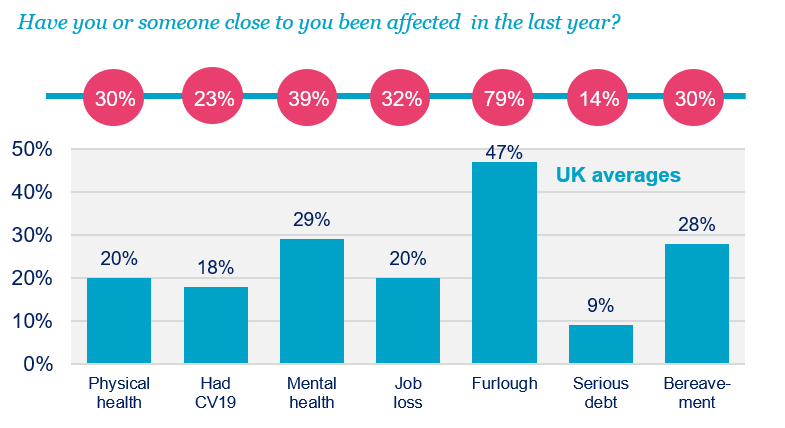

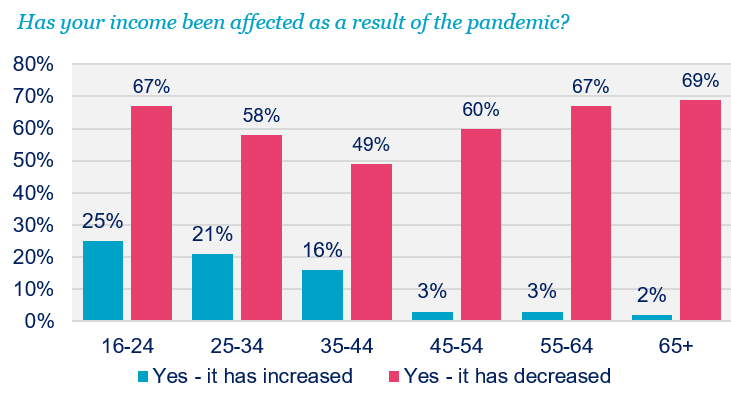

Our financial wellbeing report showed that employees working in the sector have been impacted by Covid-19 and lockdown more than the UK average in every category we measured, with 52% of those surveyed saving less or still unable to save and 43% of respondents with less than 3 months of savings. There are long-term implications for this group, along with the high level of freelancers working in the sector who will not benefit directly from most of the Budget measures, who will have likely spent more than a year accruing additional debt and building up very little, if any, long term retirement or other savings.

Though the extension of the furlough scheme will be welcome to businesses in the sector who are still not able to trade at normal levels (if at all for the time being), this could be seen as confusing alongside messages focused on reopening and driving demand.

Some may criticise that these measures are just creating ‘zombie companies’ and stalling wider industry restructuring that naturally may happen post pandemic, especially in these industries where merger and acquisition activity is already very common.

There is also the wider impact that the taxation measures announced to help fund the Budget may have in the longer term. Will they dampen consumer demand and profitability within the sector? Of course it will take years, if not decades, for the full economic impact of the pandemic to be apparent. Only time will tell how these businesses will emerge at the end of this – and how much credit or blame will be placed on this year’s Budget.

These insights are based on the Chancellor's 3 March speech and our initial reading of the Budget document, and we are aware there may be differences that arise upon more detailed reading and when necessary regulations and measures are implemented. We will keep this page updated (if necessary) as new details become available.