Multi asset funds –

evaluating their role in your portfolio

Our viewpoint

23 February 2021

We believe the current market environment is challenging for multi asset funds and some investors may find it better value for money to create a multi asset portfolio themselves.

Multi-asset funds are one-stop solutions for diversified liquid growth portfolios. The funds in our research universe invest in some or all of equities, bonds, liquid alternatives, and derivatives. Managers use different means to achieve their target returns. Funds can be passively managed and the returns market driven, or actively managed with some returns generated from manager skill which includes dynamic asset allocation (moving the allocation between asset classes and sectors), stock selection and relative value trades. Relative value funds use derivatives extensively to create directional short exposure or relative value positions.

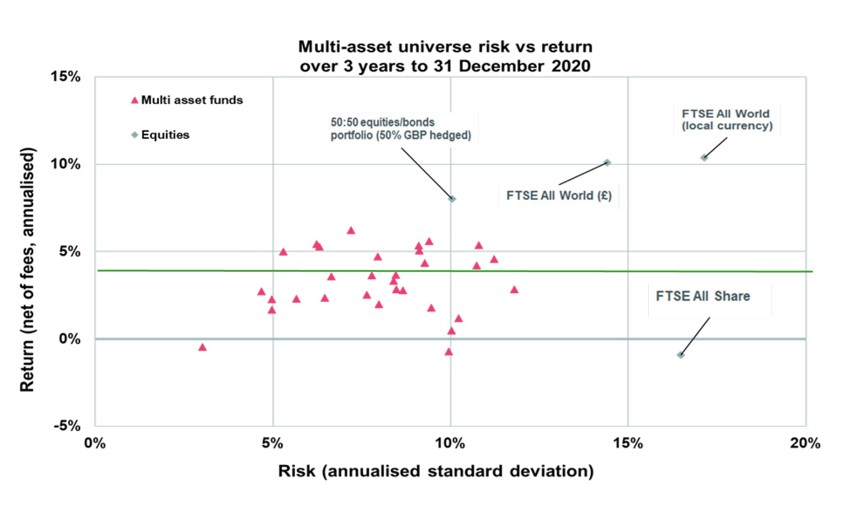

Historically, multi asset funds we monitor have generally met their volatility targets; risk being significantly lower than equities, but performance overall has been below their objectives (a typical multi asset manager objective is cash+4% pa, net of fees, indicated by the green line in the chart) . Of course, there are exceptions and some managers have met or exceeded their performance targets.

Source: Investment managers, Bloomberg. The equity/bond/gilt index/indices used are the FTSE All World GBP, FTSE All World local, Barclays Global Aggregate Corporate bonds GBP and Barclays Global Aggregate Corporate bonds local. Investment manager performance is net of standard fees. Note managers have different return and volatility objectives. Output may vary when considering data over different time periods. Past performance is not an indicator of future returns.

It is notable that the 50:50 equity bond portfolio has produced better returns than all multi-asset managers in our sample.

For most multi-asset managers in our research universe, the greatest contribution to returns over the last five years has been from equity markets. In the future, multi-asset portfolios may expect a lower contribution to returns from equities: equities are trading at historically high levels for the earnings the companies are making and the outlook for companies’ revenue and profits appears highly uncertain over the next few years.

Low government bond yields now mean that managers are not being rewarded meaningfully for holding bonds either. We therefore believe managers will struggle to achieve their investment targets in the medium-term.

A benefit of multi-asset funds is that asset allocation can easily move between equities and bonds to generate returns. If prospects for both of those asset classes look muted, managers will need to look to other assets for returns.

Some managers can and do allocate to alternative asset classes such as listed property and infrastructure, broadening the tool kit may help multi-asset managers in generating returns. It’s important to remember that the funds’ investment universe is limited as most managers cannot allocate significantly to illiquid assets (which have the potential to produce higher returns) due to the fund’s dealing constraints.

It’s also worth noting that generally where managers in our research universe have used derivative protection this has often detracted from performance. Cost has often outweighed any benefit over the last few years.

We prefer strategic diversification

In the long run, we have found that funds with persistent long market exposure produce better returns than those that rely heavily on dynamic asset allocation and / or take positions on the relative return of different markets (relative value managers). Dynamic asset allocation and relative value managers have more sporadic success; they do deliver lower risk, but normally at the expense of lower long-term returns net of their higher fees.

We do not believe that, as a group, funds relying on manager skill for a significant part of their return can consistently achieve their, still high, investment targets. The evidence is that relative value managers have struggled to achieve a high enough proportion of successful trade ideas over the long term and we are not convinced that it will improve significantly in the future. Our analysis tells us that a significant portion of the returns relative value funds do achieve has been generated from market beta rather than manager skill.

Our preference is for multi asset funds that derive a significant portion of their returns from systematic market returns using a diversified exposure to various asset classes, within a reasonably limited range of asset allocations.

Based on our analysis, we believe that a return of cash+3% pa is achievable for most multi asset funds. This is a figure generally lower than managers’ targets, but we believe funds that rely heavily on manager skill rather than market returns could struggle to achieve this.

Multi asset funds as a governance solution

If you can access all the underlying asset classes and have a sufficient governance budget, you may be able to construct a multi asset portfolio yourself at lower cost. Risk tolerance must also be assessed, for example can the portfolio tolerate potentially higher volatility? Multi asset managers are good at maintaining volatility below their targets.

Investors should consider the time spent monitoring investments when deciding whether to build their own multi asset fund or appoint a manager. You may wish to use their governance budget on other parts of your portfolio.

For some investors, multi asset funds offer a good governance solution - a diversified portfolio that delivers on risk management and liquidity and are therefore an appropriate choice.

Finally – fees

We firmly believe in assessing value for money when making investment decisions. Fees should be considered in the context of return prospects, managers that produce lower returns should command lower fees. Fees are even more important when performance is low as they comprise a higher percentage of returns.

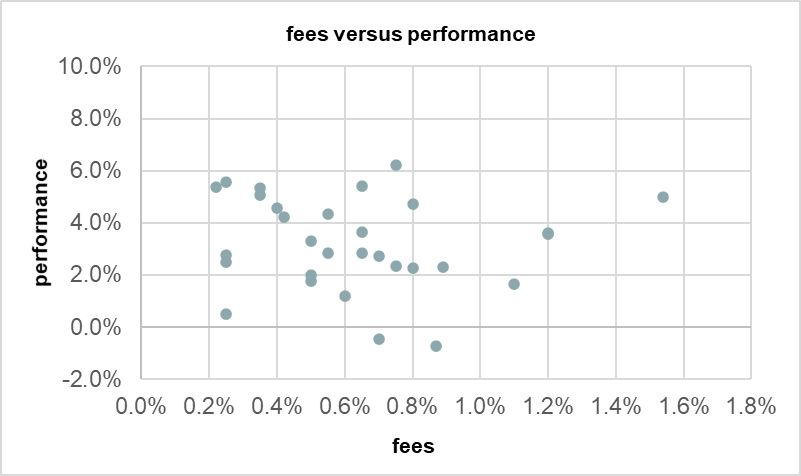

We have found no relationship between paying higher fees and achieving better performance for multi asset products. The chart shows fees versus 3-year performance annualized net of standard fees. This is a relatively short period but a similar pattern is seen over longer timeframes.

Note managers have different return and volatility objectives. Output may vary when considering data over different time periods. Past performance is not an indicator of future returns.

In summary if you allocate to multi-asset funds, evaluate their role in your portfolio. These are the key questions you need to ask:

- Is performance as expected? Are you being realistic about what can be achieved?

- Is the fund providing good diversification? Or is it highly correlated to your other investments?

- Has the fund kept close to its volatility target? If volatility is too low, will the return target be achieved; if too high is the manager chasing returns or guilty of style drift?

- Does the fund offer good value for money? Could you achieve a very similar portfolio and return profile with a combination of cheaper funds?