Equity protection

Our viewpoint

20 January 2021

During these challenging times, keeping fit is important but can be tricky with many sports facilities being closed. In my flat, my simple fitness solution is to use the stairs to go up rather than the lift. To some extent, I think there is a similarity between this and equity markets. Over recent times, equity market falls have tended to be sudden, like “coming down in a lift” whereas equity rises are often more gradual similar to “going up by the stairs”.

During the first quarter of 2020, global equities (and particularly UK equities) suffered sharp declines as the spread of Covid-19 forced governments to put people and parts of the economy into lockdown in an effort to mitigate the spread of the virus. As central banks and governments implemented unprecedented measures in an effort to stimulate economies equity markets recovered strongly, but the earlier falls caused many concerns and uncertainty for investors.

As equity markets hit new highs, we believe investors should consider locking in some of these gains given the uncertainty around how the pandemic and other risks might develop in the future. At LCP, we have been helping a number of clients over the last few months to implement equity protection structures. These structures enable pension schemes to participate on the upside up to a certain level but with significant protection against equity market declines.

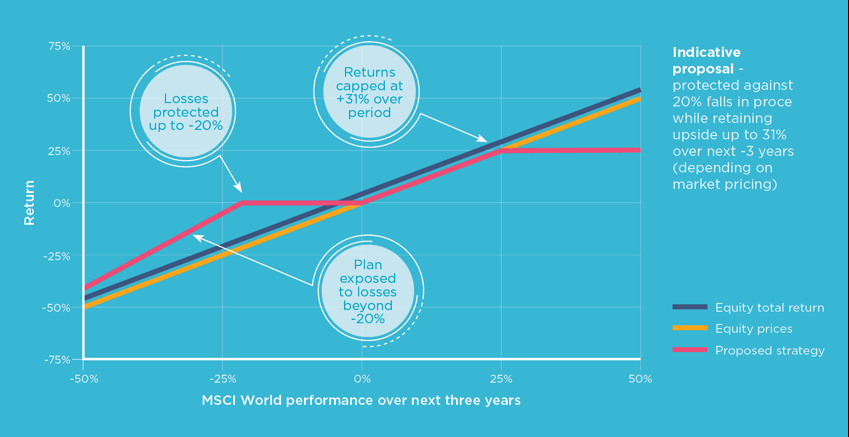

As an example, one of our clients put in place an equity protection structure with its LDI manager for the next three years (in line with its actuarial valuation cycle). The protection structure sits alongside its bespoke LDI portfolio, resulting in a straightforward and cost-effective implementation. Over the next 3 years around 30% of potential equity upside is retained whilst giving protection for equity price falls of up to 20%. An illustration of the equity protection structure is set out below. Actual pricing (ie upside and downside levels) will depend upon market conditions at the time of trading and other factors.

Illustration of equity protection strategy

There are a number of considerations that pension schemes need to consider before implementing a protective structure in their portfolios which will depend upon individual circumstances including size of position, ESG considerations, views on currency hedging, regional exposures and timeframe. However, at the current time, we believe that such a structure would be worthwhile for many investors with significant equity exposure.