How can our new

'streamlined escrow' be used to support your pension scheme?

Our viewpoint

10 December 2020

Given the regulatory direction of travel and the current economic environment, alternatives to traditional cash funding are rapidly increasing in popularity. LCP has been working with BNY Mellon and Travers Smith to provide a cost-effective, time-efficient way to set up an escrow for pension schemes.

Contingent funding approaches are rapidly becoming more widespread, for a wide range of reasons that are discussed in our blog: Contingent funding: from niche to mainstream. Escrows are a particularly versatile type of contingent funding approach, and can be an attractive option for both trustees and sponsors, as well as for both under-funded and well-funded schemes.

What is an escrow?

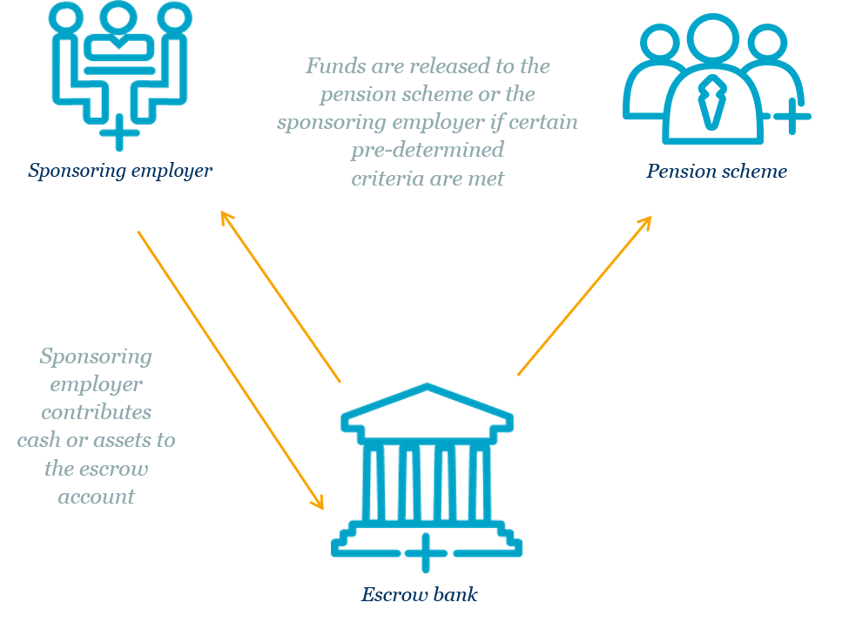

An escrow is an account in the name of the sponsoring employer, which is often held with a third-party escrow agent. The employer can deposit cash or other assets into the account, and may grant the pension scheme a legal charge over the escrow account in order to help prevent third-party creditors from accessing the funds.

The trustees of the pension scheme and the sponsoring employer agree a set of triggers, which are often linked to the funding level of the scheme, or to events impacting the covenant of the employer. These triggers determine if, when and how much of the escrow account is paid into the pension scheme or released back to the sponsoring employer.

How can an escrow be used to support a pension scheme?

Some examples of how an escrow can be used to support a pension scheme include:

- For under-funded schemes, an escrow can be used to help bridge any gap between the trustee and employer views on funding assumptions or investment strategy. For example, the additional covenant provided could enable the scheme to take more investment risk, with the escrow funds being available to compensate the scheme if these risks don’t bring the hoped for returns – on the other hand, upside returns could mean the sponsor can get its money back.

- For well-funded schemes, an escrow can be used to help prevent “over-funding”. This could mean avoiding a trapped surplus on wind-up, with the corresponding tax charge on a refund of surplus. Escrows are increasingly being used to manage these risks for full scheme buy-ins, where there is often an unknown deferred premium adjustment following a period of data cleanse. More generally a sponsor may wish to aim for no more direct scheme contributions once a given funding level is reached.

- In light of Covid-related market and covenant effects, the recent RPI reform, and the effect of recent court cases on the Pension Protection Fund (PPF), there will be a renewed expectation of materially higher PPF levies for some schemes. Certain PPF-approved contingent assets, including charged escrows, can be structured to help reduce your PPF levy and could now yield much bigger levy savings than before.

Why “streamlined” escrow?

The streamlined escrow we have just launched provides the following advantages for sponsors and trustees over approaching the open market directly:

- Quick and efficient set-up: the pre-designed contract helps you get a competitive deal without the lengthy negotiations that would be required to secure similar terms in the open market.

- Certainty on fees: the one-off fixed set-up fee includes all initial set-up costs with the escrow agent BNY Mellon, as well as a general memorandum from Travers Smith on the key legal terms of the escrow agreement and tax implications.

- Flexible investment options: there are no minimum or maximum contributions, or limits on the number of contributions or withdrawals you can make to the escrow. You can choose whether to invest the escrow assets in cash-based or gilts-based funds.

How can I find out more?

You can read more here, 'streamlined escrow for pensions', and either contact the person who normally advises you or one of our contingent funding experts.