The hardest

task in DB pensions?

Our viewpoint

11 June 2020

The Pension Regulator is currently consulting on its Twin Track approach to DB pension scheme funding – Fast Track or Bespoke.

Schemes adopting the Fast Track approach will need to adhere to a series of explicit guidelines set out by tPR which would then lead to a lighter level of scrutiny. Schemes adopting the Bespoke approach will get greater scrutiny and need to justify their approach.

So why do I think getting this regime right and specifically setting the Fast Track guidelines is the hardest task in DB pensions? Setting tight rules for funding and investment strategy to cover a wide range of scenarios and give the best outcomes for members is, to say the least, challenging. Because individual scheme circumstances can be complex, I believe that the onus should be on schemes to demonstrate why any chosen strategy would be in the best interests of the members. To see why, let’s look at just one very simple example – an underfunded scheme with a weak covenant.

A theoretical example

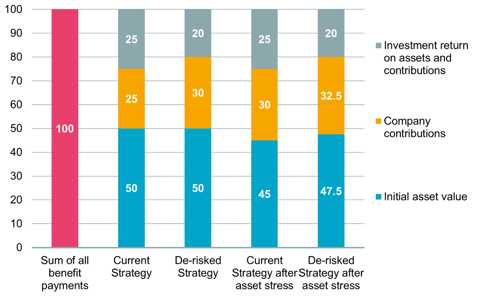

We need to find £100m to pay members all of their benefits from a combination of the assets we have, contributions we expect from the sponsor and investment returns we expect on both of these. That’s it – there are no other sources for trustees to call on.

For any strategy, we can decompose the sources of money to pay these benefits to start to give some insights on where the risks really sit. Setting the funding and investment strategy boils down to finding the right proportions of investment and covenant sources of capital and how the risks are managed over time. The sum of the contributions - the yellow block on these example strategies - broadly represents how far the scheme is from low dependency on the sponsor. When the yellow box is zero and stays zero in all circumstances, the scheme has no reliance on the sponsor.

For the current strategy, the balance between expected investment return and sponsor contributions / covenant is about equal, but each source of capital has a very different risk profile. Asset return risk is very familiar to trustees – we don’t know exactly what the return will be over time but it can be assessed using probability distributions based on assumptions about future returns. Indeed, investment return could be negative, reducing the asset base (as the stressed cases illustrate). The range of future returns is, however, to some extent within the control of the trustees, by varying the asset strategy, diversifying investments etc.

Sponsor risk is simpler but starker – the sponsor is there, or it is not. The scheme will receive the funding it needs while the sponsor is solvent. When it isn’t, funding will cease. It is analogous to the pension fund holding a large investment in a bond from a single issuer – in this case, a low quality bond as the sponsor is weak. This is not an “asset allocation” that would make many Trustees comfortable as it goes against the key principle of diversification. As investment advisers, we almost always seek to diversify those risk exposures. Many trustees also dislike holding lower quality bonds within their investment strategy and exclude them from asset allocations and investment manager mandates.

One standard response to a weak covenant is to minimise the asset risk thereby reducing funding risk and the severity of future market downside events. However, this will likely reduce the expected return too – the overall effect is to increase the “allocation” to (or, in other words, reliance on) that low quality grade bond ie the sponsor covenant.

Even looking at the situation after a 1 in 20 level stress to the funding position, the de-risked strategy does not look compelling when viewed in this way even though funding risks have been substantially reduced. It is far from obvious that the de-risked asset strategy leads to a better expected outcome for members or even if members will be better off after downside funding events. Minimising funding risk may not always be appropriate, as the knock-on implications - which only become clearer from analysis that includes some measurement on covenant reliance - may not be considered. In other words, de-risking can be risky because it puts extra strain on the covenant and finding the right balance can be tricky.

Complexity of strategy

This is a mocked-up scenario that is deliberately simple but quickly becomes complex when considering the implications of different strategies for a real-world scheme in an integrated way. In the real-world trustees and sponsor would need to deal with how the risks evolve over time – the impact of compounding poor asset returns, increasing maturity of the scheme and evolution of sponsor strength and how sponsor and pension fund interact.

Member benefits will be paid unless the sponsor becomes insolvent before the scheme reaches full funding on a no-reliance basis (either self-sufficiency, buyout, or liabilities passed to a consolidator). So, to maximise the chances all member benefits get paid, you need to carefully look at how the scheme and covenant interact to find the best strategy. For some schemes this is easy but for others, typically where the scheme is larger compared to the employer, it is much more complicated.

Working through these for real life schemes has been done for clients by us. With this in mind, we know that tPR has a really big task to find off the shelf Fast Track guidelines that are “optimal” for many pension funds let alone the majority. The regulator is, of course well aware that Fast Track will not be perfect. Perhaps success will be Fast Track being a good enough fit for a wide enough range of schemes, so that the difference between it and “perfect” doesn’t materially reduce the security of too many members’ benefits.

However, the current environment where both Trustees and Sponsors are under pressure to make every penny count will be a stern test for any new approach. The need for efficient strategies that work for all stakeholders may mean that bespoke approaches may be more optimal for many schemes and for their members.

The necessary crudeness of any Fast Track measure gives me concerns that any approach from tPR that benchmarks all Bespoke strategies to Fast Track may well give less optimal outcomes. Far better for Bespoke just to be based on core principles aligned to tPR’s statutory objectives. The onus should be on those schemes to demonstrate why their preferred approach is better at protecting member benefits, reducing risks to the PPF while minimising any adverse impacts on the sustainable growth of the sponsor. This will need work from advisers and genuine collaboration between sponsors and trustees. From our experience, these three objectives are not always, or indeed often, conflicting. However, the most effective solutions may surprise those already pre-disposed to one approach.

Perhaps this suggests one pragmatic way to for tPR to solve the problem they have set themselves - put in place some reasonable guidelines and let the hidden hand of the market decide if they are good enough. If it becomes clear to tPR that too many schemes are going down a bespoke approach, having done robust and convincing analysis, tPR could update the Fast Track guidelines to allow for these different approaches. In this way, both the industry and the Regulator partner to find and then share the approaches to strategy that give the best outcomes for members.