Making the best use

of scenarios in your Covid-19 reserving

Our viewpoint

24 June 2020

Scenario analysis can add a lot of value to reserving, especially in times of uncertainty.

This article gives some hints and tips for getting the most out of your Covid-19 scenarios – one of the key themes from my talk at LCP’s recent Reserving Seminar.

Why use scenarios?

Traditional reserving methods are being pushed to breaking point by big changes in policyholder behaviour and operational practices arising from COVID-19, eg reductions in car usage and disruptions to claims processes. This makes it more important than usual to consider scenarios alongside any standard reserving projections.

Scenarios offer the following advantages:

- Flexibility: Scenarios can be designed around the information that’s immediately available, whether qualitative or quantitative.

- Transparency: Assumptions can be made explicit in scenarios, whereas they may be implicit in traditional methods. This means that scenarios can clearly articulate what is assumed and why, making it easier for stakeholders to provide input and challenge.

- Adaptability: It is important to have the ability to switch between scenarios and update the best estimate as the situation evolves.

A framework for effective scenarios

Analysing reserves and uncertainty through scenarios isn’t new, but it is becoming more important. One problem is that scenarios are often fairly ad-hoc and set at a granular level. This can make it difficult to aggregate to the portfolio level on a consistent basis, which is what we really need if we are to understand the overall impact of something as far reaching as Covid-19.

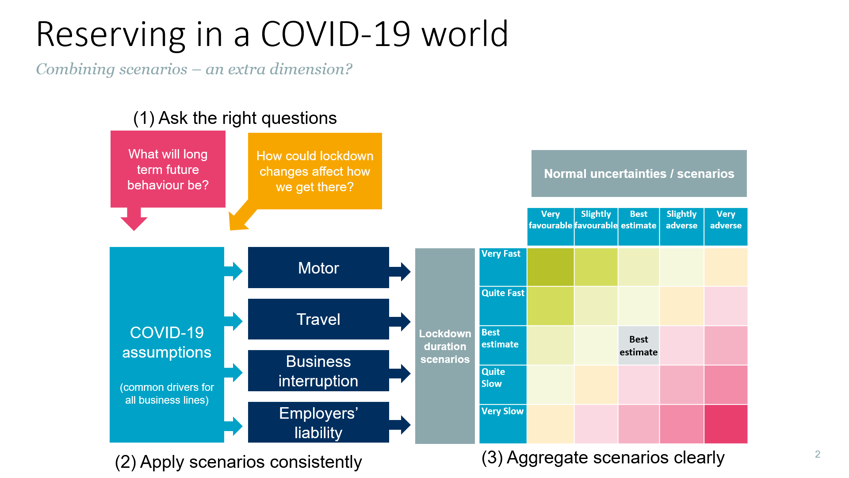

The diagram below represents a framework to address this problem. Firms are finding that a structured approach like this is really helping when responding to requests from the board for Covid-19 scenarios to help with business planning and risk management.

Asking the right questions

At the moment we’re in a period of rapid change, with lockdown introduced quickly in March and now gradually being eased. It seems like we may reach a “new normal” in the coming months, although it is still very uncertain what this will look like. A good Covid-19 scenario should explicitly address the various dimensions of uncertainty, e.g.:

- How quickly will the relevant aspects of lockdown be eased?

- Will claims trends revert smoothly back to the norm or will there be distortions (delays, spikes, catch-up of backlogs, etc)?

- What will the long term future behaviour be relative to pre-Covid, (e.g. new types of claim vs claims that won’t happen any more, inflationary effects, changes in claimant lawyer strategies etc)?

Applying scenarios consistently

In the past, scenarios were often set individually for each class. In future, it would be better to balance this with a “top-down” approach, discussing and agreeing the key overall Covid-19 assumptions centrally before applying them to each class.

It may still be necessary to apply these central assumptions differently to different classes. E.g. the impacts of a fast/slow lockdown release may be different for say Business Interruption and Travel. However, we should ensure that the real-world scenario being considered remains consistent across the board.

There should be a range of scenarios, capturing the best estimate, plausible adverse deviations and more extreme deviations.

It is also important to justify what range of likelihood the scenarios are intended to cover. E.g. is it the range of reasonable best estimates, or perhaps a 1 in 200 event.

Aggregating scenarios clearly

Applying scenarios consistently across all classes provides a good framework for aggregation, and helps ensure that reserving committees see a range of uncertainties.

A good way of illustrating additional Covid-19 uncertainty is via a heat-map approach, with the traditional scenarios on one axis and the Covid-19 analysis on the other. This approach shows, quite literally, the extra dimension of uncertainty in the reserves caused by the pandemic.

Key points to remember

Used effectively, scenario analysis can add a lot of value to reserving during the Covid-19 pandemic.

In order for the process to be effective actuaries should:

- Engage early with management to agree the questions and scenarios that will be used.

- Ensure a process is in place to apply scenarios consistently to the relevant lines of business.

- Consider the best way of illustrating additional Covid-19 uncertainties to stakeholders.

LCP’s Reserving Seminar is available to view on-demand by clicking here.