New DC investment

options – smarter, cheaper and more flexible

Our viewpoint

9 March 2020

There are three key levers your DC savers can pull and they are: contributing more, retiring later and getting more out of their investment strategy. To ensure your employees can retire when they want, without significant additional contributions, one of the questions you need to ask - are they getting enough out of the default investment strategy?

DC investment arrangements have evolved at an astronomical pace in recent years. Gone are the days of a passive equity fund de-risking into bonds and cash. But why the huge change? Are these changes adding value for employees and most important of all, are you capturing them in your investment offering?

What has changed?

In my view, the first catalyst to investment innovation was the Freedom and Choice regulations (2015). I saw this as regulatory confirmation that member retirement outcomes were outdated; for many members the best retirement outcome is rarely the purchase of an annuity. The change, allowing members to take their pensions savings as either drawdown, cash or as an annuity, began a drive to produce products catering for differing retirement outcomes.

The second catalyst has been the stark reality that over the past few years, DC pension contributions and assets have grown astronomically, driven by demographic and regulatory changes; nearly all new joiners to the workforce contribute to a DC pension, a fact rubber stamped by the introduction of auto-enrolment. This dramatic increase in the flow of money has driven innovation in investment products – DC is now many managers’ best way of guaranteeing a constant income stream going forward.

How have investment products evolved?

- Products traditionally viewed as the domain of active managers are being systematically replicated in a passive format by enterprising passive managers. One example is the rise in popularity of multifactor equities, providing an investment style empirically proven to add value for fees comparable to traditional passive equity solutions.

- The rise in the prevalence of illiquid investments has provided companies the opportunity to offer members an asset class to pair with equities in the accumulation phase of a lifestyle. Illiquids provide DC members with a previously unavailable diversifier, with a low correlation with equities and a different return source – an illiquidity premium. The rise in the popularity of illiquid products has also stimulated developments at the investment platforms DC assets are hosted on to ensure that, should a fund gate, and investments and disinvestments not be allowed for a period of time, this can be accommodated in a lifestyle structure with no impact to members.

- Traditionally lifestyle funds allocated to bonds as a method of providing members with an annuity proxy in the run up to retirement. Again, innovation has provided solutions now that are more focused targeting drawdown and so rather than matching an annuity these funds focus on downside protection or stable returns. One of my Schemes has recently made an allocation to an illiquid High Yield fund for example that seeks to return a 5% absolute target on an annual basis as a method of further diversifying their fixed income exposure.

What about fees?

Competition between asset managers has also resulted in a reduction in fees to members. One of my clients has recently reviewed their fund range and platform provider and received a 0.11% discount on fees. This may not sound much, but when projecting forward member pots, the impact on their outcomes was an extra £10,900 – a significant difference. This highlights the need for regular reviews of the funds and provider you use.

How should we capture these changes?

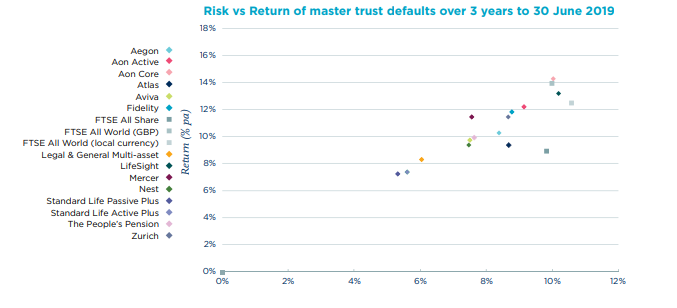

Many companies would regard it as their parental duty to members to ensure that their pension offering has, at a minimum, considered the above developments, especially with the proven value add aspect that they are having to member pots. Couple this with innovations in lifestyle designs plus the importance of incorporating actual member demographics into lifestyle design, and a compelling case emerges for a regular review of the investment offering to members. As you can see from the graph below, there is huge disparity in risk/return profiles for various off the shelf master trusts. So, whether you have your own bespoke lifestyle, or you use the standard offering of your master trust of group personal pension, you should check what it is doing, and if it’s right for your employees. Time and time again we see lifestyles that are not fit for purpose, purely because they haven’t been reviewed by the company recently, and the ideas, and fees, have moved on. Don’t let this be you.

Source: Master Trust providers. The chart shows the performance of a selection of default funds and should not be construed as a recommendation. Some of the funds shown do not have a five-year track record, therefore, to show a reasonable comparison we have used a 3 year period from 30 June 2016 to 2019. Figures are shown gross before the impact of providers' fees and scheme specific costs, which will reduce returns. Past performance is not a reliable indicator of future results

What to do?

With the rise in DC members, assets and corresponding regulation, the importance of a suitable investment arrangement, incorporating many of the considerations I outline above cannot be understated. We’ve recently seen TPR write to smaller trustbased schemes to check when they last reviewed their investment strategy, and with the increasing closeness of TPR and the FCA, it’s likely these pressures will move to all pensions soon.

But in my view, it’s not about meeting the regulations, but getting a better deal for your employees. Whilst there are many areas to focus in regards to your employee benefits, your pension strategy may actually be one of the most beneficial reviews you could conduct for your employees. I hope this article has provided you with some food for thought on that.

To see more articles like this, read our latest DC publication for our views on the hot topics in the DC retirement world right now.