What to look out

for ahead of the 2020 Capacity Market auctions

Our viewpoint

20 December 2019

The Capacity Market ensures security of electricity supply by providing a payment for reliable sources of power.

Following the suspension of the mechanism for the past year the scheme has been reinstated and the industry is now looking at the auctions taking place in 2020 to see which power stations are closing and the opportunities to build new ones.

Key issues for consideration in the 2020 auctions

There are three auctions being run in 2020: The interactions between the auctions will be challenging for many participants, especially for those looking to build new capacity.

We’ve already seen some major coal closure announcements with several nuclear power stations also scheduled to close in the 2020s. With older Combined Cycle Gas Turbines (CCGT) now considering closure decisions this could drive a need to build new power stations to replace the ones that either have or will be closing in the near future. On the other side, the commissioning of new interconnectors will continue to reduce the amount of available capacity being auctioned (as they will be price takers in the auction) but changes to allow overseas plants to directly participate in the future could change this dynamic.

The T-3 auction gives developers just over 30 months to build new plants to be operational for winter 2022/23. Reciprocating engines, battery storage, Open Cycle Gas Turbines (OCGTs) and Demand Side Response (DSR) can all be deployed in this time frame, but we might see some other larger projects come through that are ready to be built.

There are several reforms that will also have an impact on future capacity bidding into the auction including:

- Changes to network charging following Ofgem’s decision on the Targeted Charging Review including:

- Removal of the Balancing Services Use of System (BSUoS) embedded benefit which will impact distribution connected generators;

- Setting the Transmission Generation Residual (TGR) to zero will increase network costs for large power stations; and

- Implementing a fixed residual charges for final demand customers will negatively impact behind the meter generation and Demand Side Response units.

- Updated de-ratings factors for storage technologies provides greater value for longer duration batteries;

- Saturation of the Firm Frequency Reserve (FFR) market needs to be considered when looking at future revenue from this ancillary service; and

- Renewables will be able to compete in the CM for the first time but with relatively low de-ratings the overall clearing capacity (and impact on the auction outcome) will be limited.

Changes to the Capacity Requirement

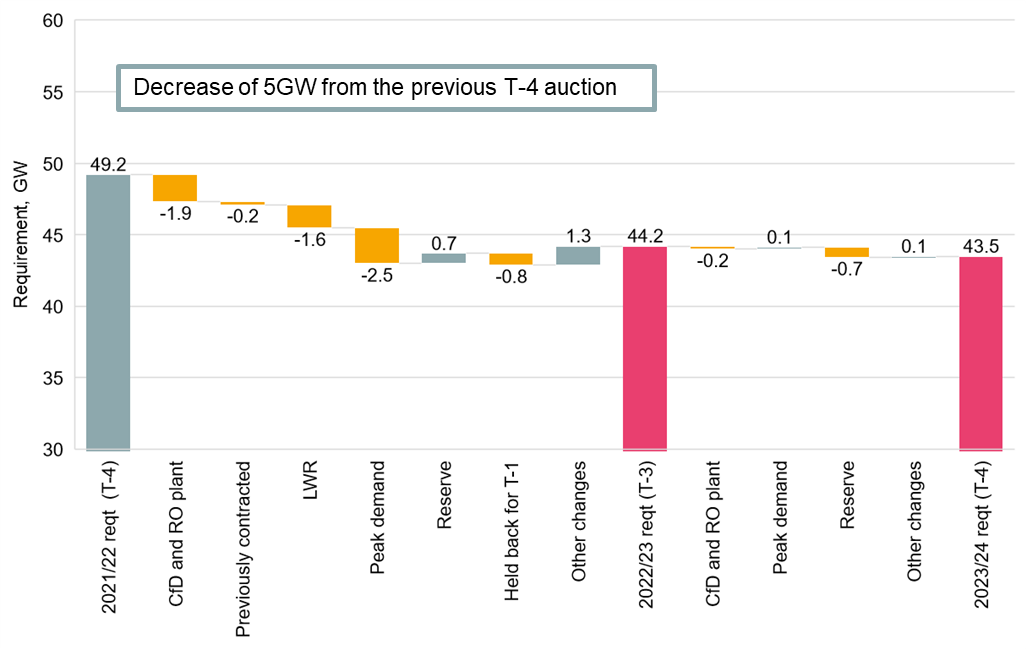

There has been a significant reduction in the capacity requirement between the previous T-4 auction and the upcoming T-3 auction. This is likely to place downwards pressure on clearing prices.

The largest factors in this drop are National Grid’s assumptions for peak demand (2.5GW decrease), Contracts for Difference (CfD) and Renewables Obligation (RO) capacity (1.9GW increase including additional biomass conversions) and the impact of its Least Worst Regrets (LWR) modelling (1.6GW) – i.e. the level of prudence relative to the basecase. There is a much smaller difference between the upcoming 2022/23 and 2023/24 auction requirements, with the main difference being a decrease in the Reserve assumption (from 1.7GW to 1.0GW). In addition, the demand curve tolerance (the difference between the target capacity and the amount procured at a price of 0) has dropped from 1.5GW to 1.0GW).

Capacity Requirement change from 2021/22 to 2022/23 and 2023/24

This lower capacity requirement needs to be considered against the upcoming plant closures and changes to policy/regulation. Understanding the interactions between the auctions will be challenging but detailed analysis of the next auctions as well as a long-term view of where the CM is heading is essential to a successful bidding strategy.