It’s time to take

action on climate change

Our viewpoint

19 December 2019

It’s time to take action on climate change

It is hard to deny that the world is currently facing a climate change crisis. So what action can investors take to assess the climate impact of their portfolio?

Activists from Greta Thunberg to Extinction Rebellion have recently made headlines and climate change has been hotly debated across the world. Quite rightly. Information released by NASA showed that 18 of the 19 warmest years on record have occurred since 2001, while a recent article, endorsed by over 11,000 scientists, urged governments to address what is increasingly being described as a climate emergency, with failure to do so leading to a future of "untold suffering".

Ok I’m listening, but what does this have to do with me?

Climate change will have wide-ranging impacts on financial markets. This could present both risks (such as transitional, physical and litigatory risks) and opportunities (from companies well placed to benefit from a low carbon economy) for investment portfolios.

New regulations on environmental, social and governance (ESG) factors came into force in October 2019. These require all pension scheme trustees to have a policy in their Statement of Investment Principles that sets out how they take account of ESG issues, including climate change. But that’s just the start – you now need to implement your ESG policy.

Whilst ESG factors cover a broad range of topics, many trustees will focus on climate change as a particularly significant issue.

This view is supported by Guy Opperman, the UK pensions minister. He has previously stated a wish “to kickstart a wholesale change in the approach of our pension firms towards the climate emergency” and recently wrote to 50 of the UK’s largest pension schemes to ask about their ESG approach, including whether they report in line with the Taskforce on Climate-related Financial Disclosures (TCFD).

An introduction to the TCFD and its recommendations

The TCFD is an international body whose mission is to help improve understanding of the serious risks that climate change poses to the global economy and organisations within it. Its recommendations for climate disclosures are driving improvements in climate-related practices by companies and financial institutions around the world.

The TCFD’s proposals are endorsed by the UK government and the Bank of England, whilst an industry working group is developing guidance for UK pension scheme trustees. The Pensions Regulator (TPR) recently updated its trustee guidance, noting that: “You [ie trustees] should consider the recommendations of the Taskforce on Climate-Related Financial Disclosures (TCFD). These recommendations provide a global framework for identifying, assessing, and managing climate-related risks.” TPR is due to consult on further climate-related guidance in 2020.

A practical way to assess climate-related exposure in a portfolio

Once climate-related factors are understood in general terms, the next step is for investors to assess the exposure from their own portfolio-specific perspective, on a manager by manager basis. We’ve done this for several clients with the help of the Transition Pathway Initiative (TPI).

The TPI evaluates risks relating to the transition to a low-carbon economy for companies in high-impact sectors[1]. It enables asset owners, such as pensions scheme trustees, to make informed judgements about how companies with the biggest impact on climate change are adapting their business models to prepare for this transition.

The initiative uses publicly available information to assess companies in two key areas:

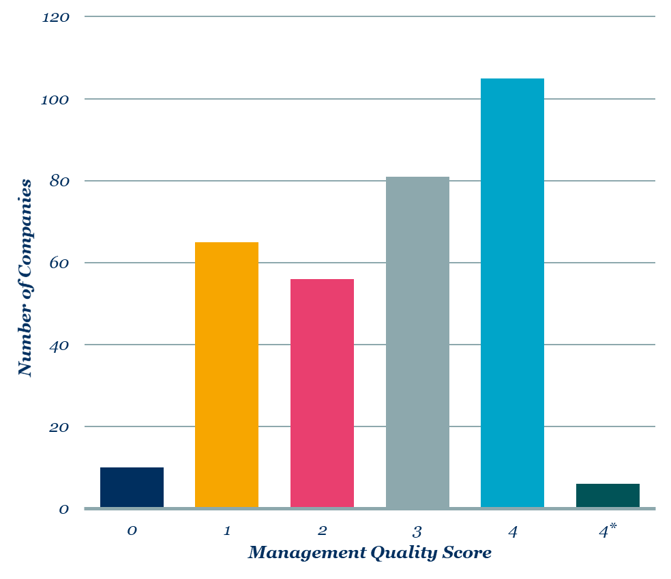

- Management quality: how well it is managing the risks relating to a low-carbon transition, such as measuring its greenhouse gas emissions, having plans in place to reduce them and conducting scenario analysis. On this basis, each company is given a rating from 0 to 4*, where 4* is highest.

- Carbon performance: how a company’s current greenhouse gas emissions and future plans to reduce them compare to the targets and pledges made as part of the 2015 Paris Agreement.

The chart below shows the latest results from TPI’s Management Quality assessment. It covers 323 of the companies that are contributing most significantly to global greenhouse gas emissions. The analysis suggests that almost all of them have got off the starting blocks in terms of managing climate risk (ie few score 0), but many of them fall short of best practice (ie few score 4 or 4*). The assessment uses a publicly disclosed methodology that is applied with academic rigour, so investors can be confident that the scores are not distorted by greenwashing.

Distribution of TPI scores, showing the different degrees to which high-impact companies are managing greenhouse gas emissions and the low carbon transition

Source: Transition Pathway Initiative, December 2019

By analysing, on an appropriately weighted basis, each investment manager’s exposure to companies assessed by the TPI, investors can get a feel for the potential impact of climate change on their overall portfolio.

We believe this analysis can be really powerful.

It has helped our clients to answer questions such as whether their actively managed funds are more climate-friendly than the passive index comparator and has been a catalyst for constructive conversations with investment managers about how they’re managing climate risks.

Importantly, manager assessment need not be limited to equities – since the TPI scores companies, it can also be applied to asset classes such as corporate debt and multi-asset investments.

How can I enhance my climate approach?

We believe it’s vital for investors to better understand climate-related exposure and how it can be improved. TPR agrees and we expect further scrutiny of trustees in the near future. Therefore, now is the time to act.

How trustees can most effectively address these issues will depend on scheme-specific circumstances, such as their investment time horizon and current investments. For many, we believe suitable action will lead to reduced risk or enhanced investment returns in the long-term.

One option is to move into low-carbon versions of your existing investments – a course already chosen by several of our clients – for example, moving passive global equities portfolios into climate-tilted equivalents that over/under-weight stocks with positive/negative climate-related exposures. A more targeted approach might be to allocate monies to climate-related solutions and opportunities; for example, via investments in renewable energy generation or through firms that drive improvements in energy efficiency or manufacture battery technology.

Additionally / alternatively, you can take indirect action to improve your climate approach by putting pressure on your investment managers to better address climate risks and opportunities within your existing portfolios. We believe it’s vital that managers continue to improve their climate practices and use stewardship to engage with investee companies to encourage the transition to a low carbon economy.

[1] These include: Airlines, Aluminium, Automobile, Cement, Coal mining, Consumer goods, Electricity utilities, Oil & gas, Oil & gas distribution, Other basic materials, Other industrials, Paper, Services and Steel.