Pensions

accounting: record low corporate bond yields drive increase in pension liabilities

Our viewpoint

17 October 2019

Corporate bond yields recently hit an all-time low. So far this year this has led to a c.20% increase in the DB pension liabilities assessed for company balance sheets. In this blog, I discuss one possible option for companies to mitigate some of this increase.

The three key assumptions for pensions accounting are:

- Discount rate: For pensions accounting, these are based on the yields of high-quality corporate bonds and should reflect the timing and amounts of expected pension payments.

- Inflation (usually both RPI and CPI): this influences how much pension a scheme will ultimately pay out.

- Life expectancy: how long the pension scheme is expected to pay out a pension.

I’m only going to focus on the first of these three assumptions here (I will address the others in blogs 2 and 3 of this series).

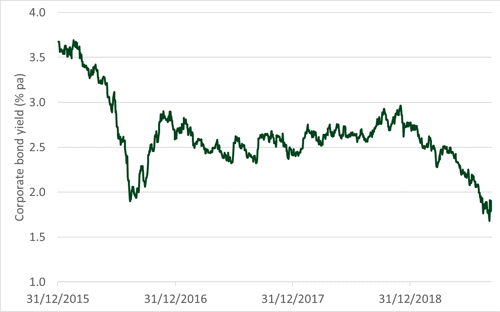

The higher the discount rate, the lower the pension liabilities on a company’s balance sheet and vice versa. In the UK, corporate bond yields hit a record low falling below 2% pa in the aftermath of the Brexit referendum in 2016 and have fluctuated between 2% pa and 3% pa since then. This pushed pension accounting liabilities to all-time highs, causing companies pain on both their P&L and balance sheets. In early September 2019 we have seen new record lows.

The chart below shows that since 31 December 2018, corporate bond yields have fallen by c.1% pa. For a typical company with a DB scheme this will cause a c.20% increase in the accounting liabilities.

Unless their schemes are fully hedged, companies are again faced with issues for balance sheets and P&L, which for some will bring knock-on implications for dividends, credit ratings, and the ability to raise capital.

So what can companies do about this fall in discount rate? There is flexibility within the accounting standards as to how to set the discount rate and we have seen a range of discount rates adopted by companies (as shown in our annual Accounting for Pensions report).

We have developed the LCP Treasury Model which addresses several issues with other common approaches and produces discount rates that are typically 0.2% pa above usual audit benchmarks (depending on scheme specifics). Whilst this may not seem like a big change, small increases in discount rates can significantly improve the overall pension accounting position.

Many companies adopted the LCP Treasury Model for setting their accounting discount rate in 2016 when we hit previous record lows as they were forced to look in detail at their accounting figures given the increase in size and materiality. This model is now established in the market and has been used to robustly set accounting discount rates for lots of companies for a number of years.

Given the latest fall in yields, is now the right time for you to revisit how you set your accounting discount rate?