Change is

coming for DB, but what does it mean today for your scheme?

Our viewpoint

17 June 2019

Following the Government’s 2018 White Paper, the Pensions Regulator (TPR) has been ramping up its guidance on how schemes should be funded and managed – the Annual Funding statements of 2018 and 2019 as well as more recent TPR blogs have clearly signalled a direction of travel toward a new world of DB pensions regulation and oversight.

In its latest corporate plan, TPR sets out new KPIs: to increase deficit contributions and to reduce the length of recovery plans. And it’s not just about funding. Views on contributions are intertwined with how investment strategy should be set, as well as how views on the sponsor’s covenant underpin all key decisions.

Despite this momentum, signs are that new legislation and TPR’s new Funding Code of Practice may not formally replace existing rules until late 2020. So, has everything changed or has nothing changed? As a trustee of a DB scheme, or sponsoring employer, you might well be asking this question, and the answer I'm afraid is - it depends.

Longer term we can see the direction of travel for the new code: a greater focus on long-term funding targets aligned with scheme maturity, managed investment risk, shorter recovery plans and a focus on the balance between dividends and pension contributions. But what does all this mean for schemes carrying out valuations in 2019 and their sponsors?

"The White Paper also introduced the concept of a long-term objective (LTO) and how trustees should achieve the scheme’s Statutory Funding Objective in that context. This will be at the heart of our revised code of practice.

David Fairs (Executive Director of Regulatory Policy, Analysis and Advice at the Pensions Regulator)

2019 valuations will take place under the current regulatory code, but TPR has indicated that schemes ought to show they are paying attention to the guidance in the annual statement, so what should trustees and companies be doing?

For some schemes who already have long-term funding targets linked to maturity, short to moderate recovery plans and modest reliance on sponsor support in Technical Provisions discount rates, then this might not actually change things that much.

For others there may be straightforward things schemes can incorporate into their 2019 valuations to align themselves with the likely direction of future regulations.

Others still may have some way to go, to get to where TPR would like them to be and have some hard decisions as to how far to move this time, with future regulation and guidance not yet clear.

We think trustees with 2019 valuations should ask themselves the following questions:

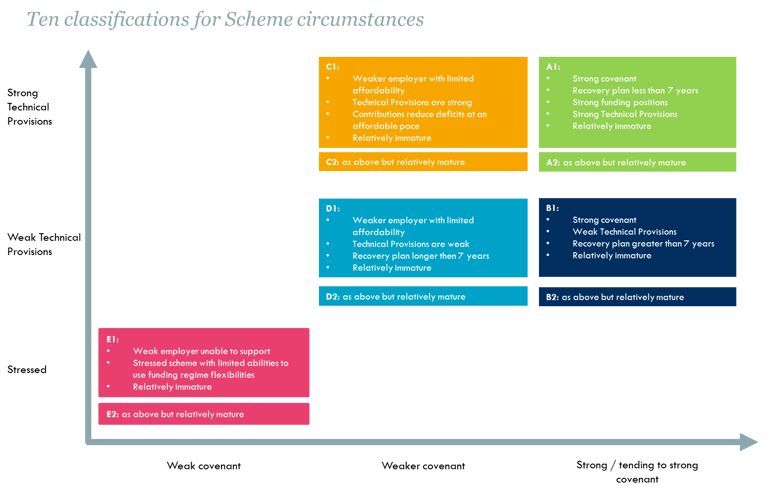

What box are you in? In the 2019 AFS TPR has introduced 10 classifications for schemes by maturity, sponsor strength and funded position. Which one do you sit in, in the chart below?

What should your end-game be? Self-sufficiency, buy-out, a consolidator or something else?

How quickly should you get to your end-game? For example, at what date do you get to the point when the average term of your future benefit cashflows fall to 10-15 years; when the scheme is very mature and likely to be very cashflow negative?

Do you have a secondary funding target, beyond your technical provisions? In the past, Technical Provisions have been the key regulated funding measure. The future looks likely to feature two measures with a Long Term Funding Target alongside Technical Provisions (which continues to drive contributions). If your scheme hasn’t set a long-term target before, the valuation would be an ideal time to consider what this should be, and how the TPs should progress over time towards that target.

What does the sponsor think? For the first time, the 2019 annual statement was addressed to sponsors as well as trustees. TPR has highlighted that good practice is to work collaboratively with sponsors when setting long term strategic objectives for the scheme.

How much sponsor strength is assumed in the technical provisions funding basis? TPR have indicated this will be an area of focus, schemes should document the logic behind the conclusion reached on the covenant, especially if they have not received independent advice.

Has the current level of investment risk been quantified? Could this be supported by the sponsor's covenant, e.g. by free cash flow or current earnings? Or are there contingency plans in place – for example additional contributions available under Escrow?

Is there a plan in place for investment risks to be reduced as the scheme matures? There are all sorts of mechanisms that could support this, including time, funding level or required based de-risking triggers.

What is the current level of dividends compared to pension contributions? Is there any other "covenant leakage" that the trustees should think about such as debt issuance? This simple ratio appears to be a focus for TPR, while a broad and imperfect measure, it does get at the necessary balance between security for members and stability for companies. It is bound to be a talking point over coming years so important for trustees to know where they stand and use this to set the context for the negotiations with the sponsor.

How long should your deficit recovery plan be? TPR has indicated that Recovery Plan lengths should continue to shorten and that for the strongest employers they should be less than the “average” length of 7 years.

Could you agree additional security for your scheme? To square the circle with longer recovery plans and lower affordability it appears that TPR is clearing a pathway for asset-backed funding and security arrangements to be a part of the new code. If this is likely to be a factor for your scheme it could be worth trustees and sponsors considering this as part of the 2019 valuation.

"We don’t intend to pursue a ‘one size fits all’ funding framework – this is not MFR 2.0. The flexibilities in the funding regime will remain to help trustees and employers reach balanced outcomes".

I should end by noting that your duty as trustees and sponsors of pension schemes under the scheme funding legislation is to agree appropriate assumptions, recovery plan and contributions, having taken appropriate professional advice. Most will also want to stay in TPR’s good books but, for now anyway, whatever TPR says is just helpful guidance.