The lure of

freedom – is it all it’s cracked up to be?

Our viewpoint

22 March 2019

As the value of “flexible payments” being cashed out of pension schemes jumps 20% in a year, Alex Waite argues that a default policy for turning savings into income would be no bad thing…

Freedom can be intoxicating – especially to those whose liberties have in some way been curtailed. And so it is proving with pensions.

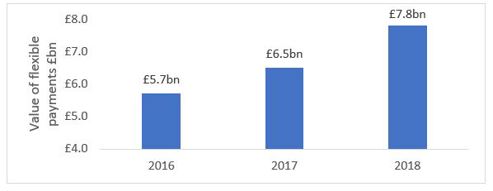

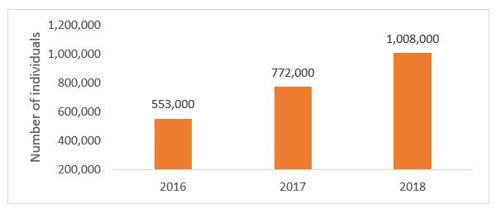

Almost four years on from the introduction of so-called “pension freedoms”, the government’s analysis shows that more and more individuals are extracting “flexible payments” from their pensions. Over a million people cashed out a total of £7.8bn last year. In value terms that’s up 20% on the previous year alone.

Total value of flexible payments from pensions jumps 20% in one year to hit £7.8bn…

…with more than 1m people taking cash out

Source: Flexible Payments from Pensions: January 2019

Moreover, newspaper headlines have flagged up the high numbers of workers transferring out of DB pension schemes, with almost a quarter of a million NHS workers being a case in point. Given that DB schemes are rarely mentioned in the media without the tag “gold-plated”, it’s reasonable to ask if such freedoms are necessarily a good thing. Especially in light of reports that mis-selling pay-outs in the pension transfer market have doubled.

Of course, there can be good reasons for taking lump sums out of a pension pot or transferring out of a DB scheme. For example, the flexibilities allow the savers to choose when they take income, and there can be important tax advantages for those who transfer. Furthermore, if the former employer winds up, it may be better to have the pension money in your own pension account. However, there’s a question of balance to be struck between freedom of choice and the need for some structure and advice around those choices.

The compulsion/choice debate

Pensions policy, as it currently stands, is inconsistent. On the one hand, policy-makers have opted for a degree of compulsion, encouraging workers to save for a pension by creating an “auto-enrolment” framework for them to default into. Curiously, there’s no need to take advice about saving, everyone is “opted in” and will save unless they “opt out”.

But on the other hand, the government rejected the Work and Pensions Select Committee’s recommendation last April that there should be a default decumulation pathway, too, to guide people around what to do with their pots as they approach retirement.

That seems counter-productive. Lack of guidance and poor advice (if any) on what to do with this money when retirement finally comes around could put all those years of saving at risk. There is too much opportunity for confined pension scheme members to take advice from the wrong adviser and end up draining their savings due to ridiculously high fees.

The key consideration here is maintaining income for life. The prime reason for pension saving for the majority of working individuals is not to buy a Lamborghini – or to leave an inheritance for their children – it is to provide an income. Having a default way of turning pension savings into that income is something I think many Future Pensioners would welcome. If the risk of living “too long” can be cost-effectively pooled with others, all the better.

Freedom from the need to make decisions

I’m all for free choice, but as we’ve seen with auto-enrolment, a default pathway can actually be very liberating, absolving Future Pensioners from the need to make decisions (unless they want to). Too much choice leads to confusion and the opportunity for many people to make poor decisions as they reach retirement.

I’m not advocating a total relinquishing of responsibility here – I don’t believe Future Pensioners should take a totally hands-off approach to their retirement savings or blindly trust that the default, one-size-fits-all solution is sufficient for their needs. As two greats of philosophy, Nietzsche and Spiderman said, “freedom is the will to be responsible for ourselves”.

But – despite this – and at the very least, a default option is surely better than none, as at least that would give a benchmark against which alternative options could be considered as part of the retirement advice process. Time for coherent policy at both ends of the pensions savings process, I think.