Pumping up

for the pensions work-out

Our viewpoint

7 February 2019

Committing to losing pounds at the gym in 2019 is a worthy aim – but so is gaining pounds on Future Pensioners’ retirement pots, says Laura Myers.

The first few months of the year are traditionally when people join a gym to get back into shape after the excesses of the festive season. Whether the prospect fills them with adrenaline or dread, those would-be gym bunnies have all got a clear aim in mind – to become healthier and fitter in the year ahead.

What if the same drive for self-improvement could be applied to pensions? Millions of people could benefit from training the same focus on their financial fitness as they do on their abs and biceps.

Investing in health and wealth

Let’s take the average monthly cost of a gym membership – currently in the region of £20-£50 depending on type of contract, location and facilities. Saving the same amount into a pension over the course of a year could make a significant difference to wealth in retirement.

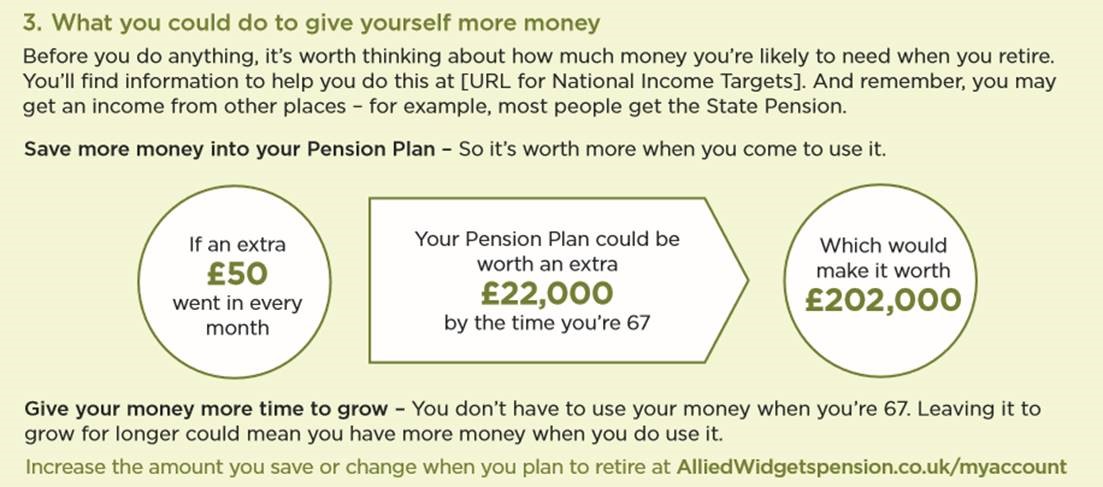

This is where Section 3 of the proposed new simplified annual statement comes into its own. This part of the statement shows Future Pensioners how much difference an extra, say, £50 per month could make in the long term, putting it in an easy-to-understand visual format, like so:

*“The simpler annual pension statement has been produced by Ruston Smith, an adviser to the Government on its review of automatic enrolment, with input from the pensions industry including the PLSA”.

This gives people a clear target to aim at. That’s one of the reasons why we’re keen to see DC providers and administrators adopt the new statement template – pushed by a little light coaching from trustees and governance groups if necessary…

As HR professionals well know, exercise and physical wellbeing bring enormous benefits to employees and employers alike, and I’m not suggesting that Future Pensioners should swap the cost of the gym for retirement savings. But if they could afford to allocate as much again to their financial goals, they’d be more likely not just to live a long and healthy life into old age, but a comfortable one too.

Cheerleading Future Pensioners!

Just like exercise, pensions saving requires sustained commitment – a regular ‘routine’ - if any real benefit is to be gained. To avoid the risk of throwing in the towel after just a few months, we as an industry have an important role to play as “cheerleaders”, encouraging Future Pensioners to keep going and to play the long game.

The simplified annual statement may not be as sparkly as the pom-poms real cheerleaders use or as showy as their somersaults – but when it comes to getting the right end result, it might turn out to be just as effective! Go, go Future Pensioners!