“Obscure government document reveals “hundreds of thousands” of older women still missing out on correct state pension – and will not be contacted” – Steve Webb, LCP

Media centre

24 March 2023

DWP is currently in the middle of a multi-year correction exercise to identify over 200,000 people who are being paid the wrong rate of state pension. The Department is searching its records to find these people and will contact them and pay arrears.

But an obscure document supplied by DWP to an appeal Tribunal last year reveals that there are ‘low hundreds of thousands’ of older married women who are not receiving the full state pension they could be getting but who DWP has no plans to contact.

The group affected are married women who are currently getting less than the standard 60% ‘married woman’s rate’ of basic state pension (£85 per week) but whose husband is now aged 80 or over (and therefore turned 65 before 17th March 2008 – fifteen years ago). For these women, a higher state pension may be available (the full £85 married woman’s rate, assuming the husband has a full basic pension of £141.85), but only if they claim it. Because many such women are unaware of their entitlement, they continue to receive a reduced state pension. And DWP argues that there is no ‘error’ in these cases because the women concerned have simply failed to claim what they are entitled to.

Until now, it was unclear how many women were in this situation, but a document submitted by DWP to a Tribunal hearing last year says that DWP has scanned its computers and that “in the low hundreds of thousands” of women could be in this position.

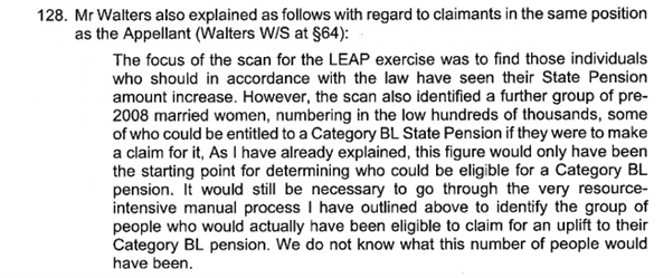

The disclosure, from a DWP staff member, and submitted by DWP in evidence to the Tribunal is below (note that the ‘LEAP’ exercise is the correction exercise described above):

Source: Upper Tribunal judgment: IN THE UPPER TRIBUNAL (publishing.service.gov.uk)

After 17th March 2008, married women in this position should have got an automatic uplift to the 60% rate when their husband drew his pension, and if this did not happen, DWP will try to find people and put things right. But for the ‘pre-March 2008’ women, DWP has excluded them from the correction exercise because the onus was on the women to claim the uplift. The DWP submission to the Tribunal is believed to be the first official estimate of the numbers which could potentially benefit from an uplift.

All of these women have potentially been missing out on a higher pension for at least fifteen years. If they applied now, they would get an increase, but it would only be backdated for 12 months.

Now Steve Webb, the LCP partner who helped to identify the wider issue with state pension errors, is encouraging older married women to check if they may be entitled to an uplift. LCP has a web page where married women can check if they are on the correct rate of basic state pension, which has had over 950,000 hits since it was first created.

Steve Webb said:

“It is shocking that the government knows that hundreds of thousands of older married women could be on a higher pension but has done nothing to make them aware in the fifteen years or more since their husbands retired. I would encourage any married woman with a husband over 80 and who has a basic pension under £85 per week to check if she may be entitled to a higher pension”.