Avoid ‘panic buying’ of DB pension transfers

Media centre

17 July 2022

New analysis of the transfer values offered by Defined Benefit (DB) pension schemes has warned members to avoid rushing into a transfer purely because of worries over falling transfer values.

When long-term interest rates fell to ultra low levels in the late 2010s, the transfer values offered by DB pension schemes reached record levels. In simple terms this is because low interest rates made DB pensions expensive for schemes to finance and meant they offered higher transfer values to those willing to leave the scheme.

For many members with long-service in a DB scheme, the transfer value of their DB rights could exceed the value of their family home. These very high transfer values were an important factor in the surge in DB transfer activity that took place in the second half of that decade, with activity peaking in 2017.

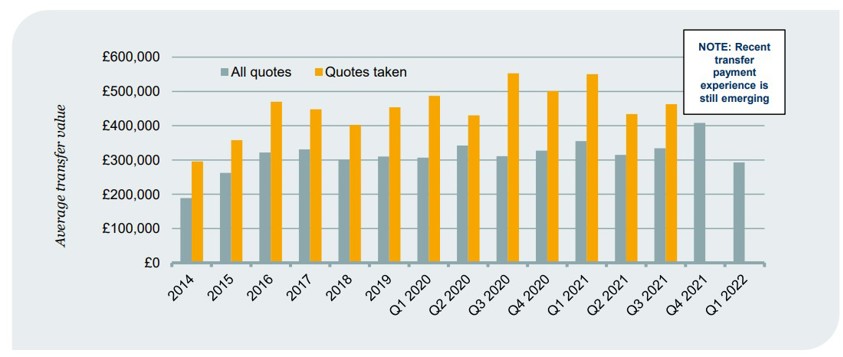

Transfer values have stayed at very high levels for several years but in recent months have started to decline. Latest estimates by LCP, based on transfer value quotations for more than 70 DB schemes, suggest that the typical transfer value quotation in the first quarter of this year was just under £300,000, compared with a peak of just over £400,000 in the final quarter of 2021. The chart below shows annual figures from 2014-2019 and quarterly figures from Q1 2020 onwards, and gives figures for all transfer value quotes issued (grey bars) and for those actually taken up (orange bars).

Source: LCP analysis of transfer values

Members may be concerned that transfer values will fall further if long-term interest rates continue to rise, and may be tempted to rush into a DB transfer to cash in before values fall.

However, new research published by consultants LCP shows that there is a variety of factors which can influence the generosity of transfer values, and whilst some factors may point to lower values in future, others could lead to higher values for those prepared to wait. As a result, LCP warn members against rushing to transfer out their DB rights purely in an attempt to ‘time the market’ for transfer values.

The research points out that pension schemes have discretion over how they set their transfer values, and that there can be a large variation from one scheme to the next in the transfer value offered for an identical pension. The LCP survey shows that for those ten years out from retirement, the amount offered by some schemes can be double that offered by others.

The research identifies several factors which can affect the generosity of transfer values:

- The age of the member – other things being equal, the transfer value for any given member will tend to rise as they get closer to retirement; this is because the scheme assumes that the investments used to back the pension promise will make an investment return, and as the member ages there is less time for that return to be made, and so the amount needed to back the member’s pension promise tends to increases, so the transfer value tends to increase

- The “generosity” of the pension scheme – over time, many pension schemes are derisking their investment strategies and this is also the regulatory direction of travel; a pension scheme with lower risk investments will tend to offer higher transfer values than one with higher risk investments; the LCP research finds that for those ten years out from retirement there has been an average improvement of over 10% in the generosity of transfer values for any given pension over the last 3 years when compared like-for-like; this appears to be primarily because schemes have been derisking their investment strategies, and this is an effect that LCP expect will continue into the future

- The longevity of members – where members on average live for a long time, pensions are more expensive to provide, and so transfer values tend to be higher, and vice versa; if the Covid-19 pandemic leads schemes to reduce their assumptions about the life expectancy of members, this will tend to lead to a modest reduction in transfer values.

As this analysis shows, there are multiple factors affecting transfer values, and rising or falling long-term interest rates are only one of these. Some other factors (such as individuals getting generally higher transfer value quotes as they get nearer to retirement, and the trend for schemes to derisk their investments) would tend to mean that an individual might expect to see their transfer value rise over time, whereas others (such as trends in longevity) might mean that values may fall back.

Commenting, Clive Harrison, partner at LCP and author of the report said:

“Although a further increase in long-term interest rates could lead transfer values to fall, there are other factors which could go the other way. Our research suggests that many schemes have improved their transfer values in recent years, and that trend may well continue. We also find that for an individual member their transfer value is likely to increase as they get closer to retirement, other things being equal. This means that DB scheme members should be careful not to ‘panic buy’ DB transfers on the assumption that transfer values will only go in one direction. Transferring out of a DB pension is a big decision which should always be made after taking careful note of expert and impartial financial advice”.