InsurSight takes the pain out of the reserving process, freeing up time for insurers to address critical market developments

Media centre

21 June 2022

Insurers are under increasing pressure to respond to market developments and regulatory requirements. In 2022 alone, key items on insurers’ agendas include a spike in claims inflation, global political unrest and continued pressure on expense ratios.

To help insurers combat this, LCP has launched a new version of its analytics platform LCP InsurSight. InsurSight enables insurers to materially accelerate their data analytics and reserving processes.

Legacy processes that previously have taken weeks, can now be done in minutes, freeing up valuable time to tackle wider industry issues. For the first time, integrated machine learning has been combined in a collaborative platform to firmly place analytics at the heart of the modern reserving process.

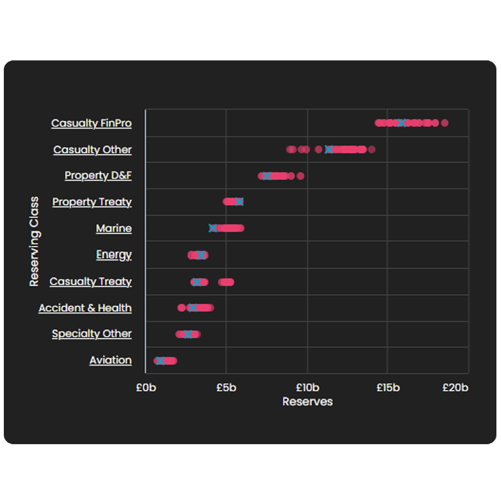

InsurSight is an award winning platform, originally launched in April 2020. It’s already being used by some of the largest London Market and international insurers to assess over £100bn of insurance reserves.

Key new features of the platform are:

- Integrated artificial intelligence delivers your first-cut reserves in minutes.

- Key reserving assumptions are automatically highlighted, to focus on judgments that really matter.

- Easy to fine tune assumptions, with a full range of diagnostics.

- Delivered through an agile and collaborative platform.

Tom Durkin, Head of LCP’s Insurance Consulting Practice, commented: “I’m so excited to be launching this game changing reserving platform. Understanding data and adopting automation are crucial for insurers to have a competitive edge. LCP InsurSight will transform how firms approach reserving, giving them more time to address key market and regulatory issues.”