On point paper:

Mind the transfer advice gap

Media centre

3 October 2021

For many years a Defined Benefit (DB) pension has been seen as the ‘gold standard’ of pension provision, with members insulated from the ups and downs of the stock market and a measure of protection against inflation through retirement. However, research by the Financial Conduct Authority (FCA) had already shown that the number of advisers with permission to provide DB transfer advice halved from just over 3,000 in Autumn 2018 to around 1,500 at the start of 2021.

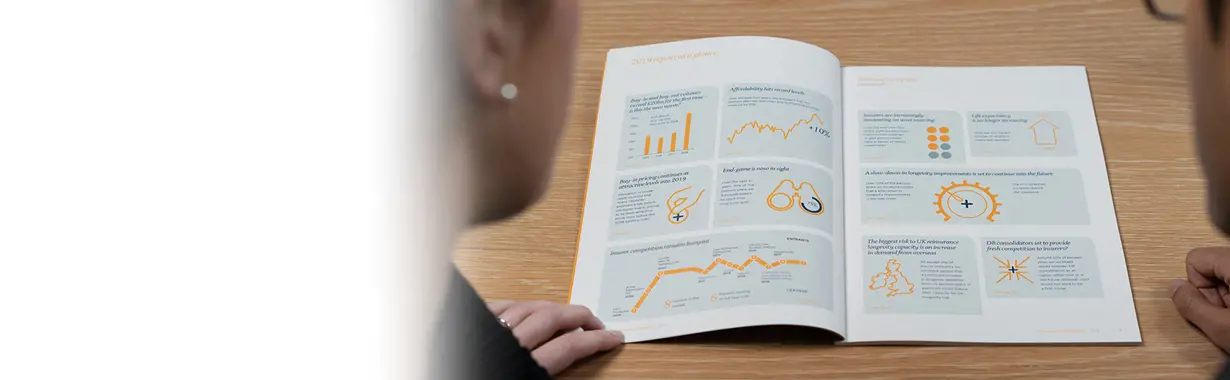

This joint paper from Aviva and LCP delves into the issue and assesses the ‘state of the nation’ when it comes to DB pension transfers and the advice available to DB members. Specifically, the research provides the first opportunity to assess the impact of a package of regulatory changes implemented by the FCA in October 2020.

The paper has two parts: A survey of over 200 financial advisers who either currently give advice on Defined Benefit transfers or who have recently done so, and on 7 in-depth interviews with ‘scheme-appointed’ IFAs, carefully selected by pension schemes to give advice to their members at reduced or nil cost. These seven firms alone account for at least 1 in 5 of all DB transfers.

The paper also explores how action can be taken so that members can source a high quality and affordable adviser and how Pension Schemes can do more to provide access to a quality-checked and affordable source of advice via the scheme.

Key discussion points include:

- Growing numbers of schemes are appointing IFA firms for members to use if they wish. In many cases this advice is either free or considerably cheaper than if members source the advice themselves. All of these ‘scheme-appointed’ IFAs said they were seeing a growth in business

- Health concerns have become far more important compared with a similar survey three years earlier on the reasons behing why members want to transfer. This could be due to the impact of the pandemic, causing members to think about what would happen to their pension rights if they were to die

- The advisers interviewed said that they often recommend using part of the transferred funds to buy an annuity. This can help to provide a guaranteed income floor for those ho have given up guarantees by leaving their DB scheme, whilst allowing them greater flexibility with the balance of their funds;

- Most scheme advisers said that new rules requiring them to benchmark the destination of transferred funds against a low cost workplace pension had had little effect