Millions of workers face ‘life-changing’ retirement shortfalls as lower growth forecasts set to wipe a third off pot values

Media centre

9 May 2021

- Falling long-range forecasts for real returns on the money invested in pension funds mean workers must contribute half as much again to their pension to get the same predicted amount out, compared to a decade ago

- A typical worker on average pay, who puts 8% in their pension from age 22, would receive a pot forecast of £85,000 based on growth assumptions in 2017; for a 22-year old who started work ten years earlier in 2007, the forecast retirement pot would have been £131,000 - £46,000 higher

- New report shows that savers planning to contribute 8% into a pension a decade ago would now need to contribute 12% to achieve the same target pension pot taking account of potentially ‘lower for longer’ returns

- Inconsistencies in projections quoted on pension statements can lead to confusion and difficulties making financial plans. The impact of inflation and charges further muddles the picture.

Falling returns from equity and bond markets could result in significantly lower retirement pots than previously predicted for more than ten million workers paying into defined contribution pensions*, according to a new report.

The joint report from interactive investor, the flat-fee pension platform, and LCP, the actuarial consultancy: ‘Is 12% the new 8%?’, examines the impact of lower annual growth forecasts for equity and bond markets on workplace pensions. It concludes that those who planned to save 8% into their pension a decade ago would now need to save 12% to plug the potential gap between expectations.

The report points out that the statutory minimum contribution rate for automatic enrolment pensions – just 8% of a band of ‘qualifying earnings’ – was set in a time when forecasts for growth rates were higher but that things have changed dramatically since then as we move into a ‘lower for longer’ growth world.

The report highlights that many people paying into pensions could be overly optimistic about the rate of growth their retirement pots are likely to benefit from in future. A poll by interactive investor** found that one in eight respondents think that equity markets will grow by 10% or more each year for the next 30 years.

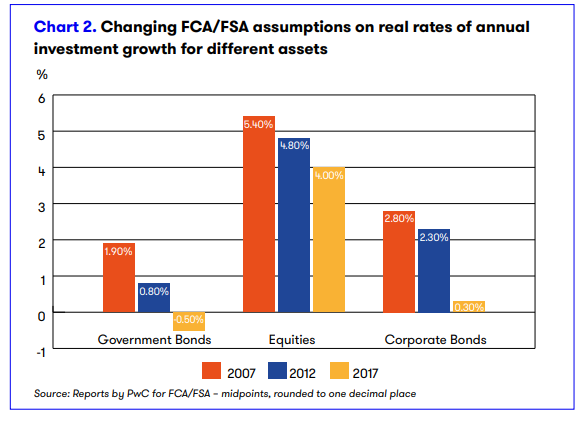

The chart below (from the report) shows how the real rate of return for major types of investment has been steadily reduced in official reports produced for the Financial Conduct Authority at five-year intervals.

Based on these figures, Table 1 shows a weighted average real rate of return for a simple portfolio comprising 60% equities, 20% corporate bonds and 20% government bonds based on the reports published in 2007, 2012 and 2017 – a fall from 4.2% in 2007 to 2.4% in 2017.

Table 1: Weighted average real rate of return on an illustrative pension pot based on growth assumptions in a) 2007, b) 2012 and c) 2017

| 2007 | 2012 | 2017 | |

| Weighted average rate of return | 4.2% | 3.5% | 2.4% |

Source: LCP

Table 2: Size of illustrative pension pot at different ages based on real rate of return of a) 4.2% and b) 2.4%

| Age | 4.2% return | 2.4% return | Difference |

| 40 | £32,433 | £27,442 | -15% |

| 60 | £103,895 | £70,947 | -32% |

| 65 | £131,298 | £84,604 | -36% |

| 70 | £164,077 | £99,595 | -39% |

| 75 | £203,286 | £116,052 | -43% |

Source: LCP

The report makes a series of recommendations for individual investors, employers and policymakers, to urgently address the looming shortfall that could occur if declining growth rate forecasts turn out to be accurate.

Becky O’Connor, Head of Pensions and Savings, interactive investor, said:

“This report highlights the impact of lower forecast investment growth on pension pots and the profound implications for the generations of workers whose retirement pots are fully exposed to the fortunes of global markets, without many even knowing.

“‘Lower for longer’ investment growth could mean the difference between scraping-by and being comfortable in retirement, but the impact of stock market performance on retirement outcomes may be poorly understood.

“Now we live in a potentially lower growth world, this needs to be reflected by recommendations for higher minimum pension contribution amounts.”

Dan Mikulskis, partner at LCP, said:

“When we look at our investments, we tend to ask how have they performed, but the more important question is often how will they perform.

“Future stock market returns are one of the most debated areas in investing. The truth is no-one knows for sure. Commonly used assumptions right now expect annual returns of around 5-6% per annum, for stock markets, over the long term, and much less for bonds. But our survey shows that 40% of individuals expect more than this.

“We’ve entered an age of responsibility, where more and more people have now become investors, responsible for their own financial security. Looking under the hood of investment products and asking questions like: ‘How much of my assets are invested in stock markets? How much in bonds?’ is vital.

“The industry needs to step up and do better to help investors be realistic here, getting past the jargon and sales guff to actually help produce tools that help savers understand how their money may grow, and the impact of things like inflation and fees over the long term.”

Becky continues:

“Because of the uplift to contributions from tax relief, pensions still make sense over other ways to invest for retirement even in a lower growth world.

It’s worth bearing in mind, for example, that headline rates on cash savings accounts do not take into account inflation – if they did they would show minus figures now - whereas forecast growth rates for pensions usually do reflect inflation.

But now more of us have defined contribution pensions and will depend on them, thanks to auto-enrolment, we may need to look to put more into them, if that’s possible.

“We also need to take care when using online tools and looking at statements that the investment growth rate assumption being used is realistic. A wildly out-of-kilter growth rate can drastically affect your forecast pot size and in turn, your plans for later life.”