“The ski slope of doom”

– is this the most important chart in pensions?

Media centre

24 April 2021

A major new research report from consultants LCP has found that the incomes of newly retired workers are set to fall at a much more dramatic rate in the coming decades than had previously been thought.

The report finds that for those working in the private sector, the decline of traditional ‘final salary’ type pensions is more rapid than previously thought and that the rise of new ‘pot of money’ workplace pensions will take longer to make a real impact than previously assumed. Together, these two factors combine to create a downward slope in at-retirement incomes which has been dubbed ‘the ski slope of doom’.

Until now, the working assumption of policy makers has been that the historic legacy of final salary pensions will largely tide us over until new workplace pensions – bolstered by automatic enrolment – comes to take their place. But this new analysis, based on extensive new modelling from a range of data sources, argues that this assumption is wrong for three reasons:

- Past modelling has ‘lumped together’ around six million public servants such as teachers, nurses and civil servants, who are still building up good salary-related pensions, with tens of millions of private sector workers, the large majority of whom are not building up any salary related pensions; the resultant ‘average’ figure tells us nothing about either group;

- Figures which show how ‘pensioners’ as a group are faring relative to workers have been an average over all pensioners, and have not focused just on those retiring today; not surprisingly, newly retired pensioners tend to be better off than elderly widows, and this tends to raise the overall average of pensioner incomes year-by-year, making us feel that ‘pensioners’ are doing well as a group; but this disguises the fact that in future the newly retired will be getting steadily worse off;

- Although automatic enrolment has brought around 10 million extra workers into pension saving, mostly into new ‘pot of money’ pensions, these pots will take a very long time to be reflected in meaningful at-retirement incomes; the mandatory 8% contribution was only finally introduced in 2019, and it will be decades before the majority of newly retired pensioners will have a meaningful pension based on that rate of contributions.

The new report brings together new LCP modelling of private sector salary-related pensions with new estimates from the Pensions Policy Institute of future ‘pot of money’ pensions to show the dramatic change over coming years. In particular, the charts show that men – who have in the past received the lion’s share of private sector salary-related pensions – will see their real incomes at retirement fall dramatically, whilst women’s pensions will rise only slightly.

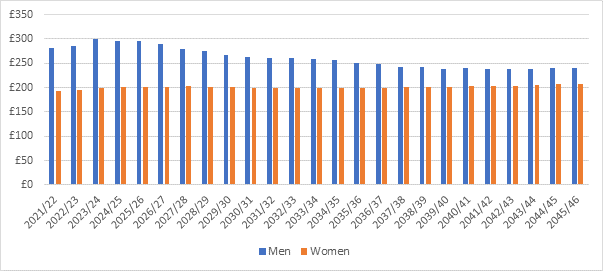

Chart 1 shows total at-retirement incomes for private sector workers in current earnings terms for men and women for each of the next 25 years.

As the chart shows, male pensions at retirement are currently substantially more than female pensions, and that gap will grow slightly in the next few years. But after this, male pensions will fall sharply relative to earnings. Women’s pensions grow slightly, mainly because of improvements in state pensions.

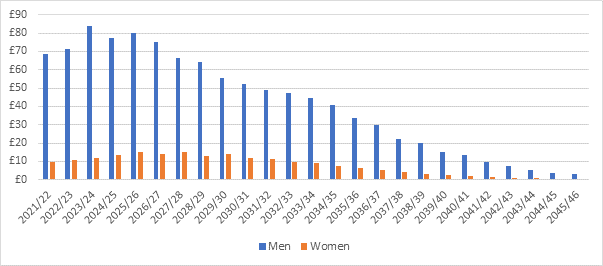

A key driver of this result is the decline of private sector salary-related pensions as shown in Chart 2- the ‘ski slope of doom’.

Chart 2. Average at retirement income from private sector salary-related pensions in current earnings terms

Chart 2 highlights the extent to which it has historically been men who have dominated income from private sector salary-related pensions (whereas in the public sector there are more women than men building up salary-related pensions). However, this means that as private sector salary-related pensions die out, it is male pensions which slump as a result.

Further analysis of future ‘pot of money’ pensions contained in the report shows that the decline in traditional salary-related pensions in the private sector will not be offset for years to come by new-style workplace pensions.

Commenting, the report’s author, LCP partner Steve Webb said:

“We have been living in a fool’s paradise when it comes to incomes at retirement. For years, salary-related pensions from private sector jobs have supported the incomes of the newly retired, and men in particular. But these pensions are disappearing much more rapidly than we thought. And new-style workplace pensions are not being built up quickly enough to take up the slack. We need a step change in the urgency of pension reform. Unless urgent action is taken to increase the pace at which new pensions are being built up, a whole generation of people will retire on lower incomes than previous generations or will have to work longer before they can afford to retire”.