LCP predicts steep energy price rises as Europe emerges from lockdowns

Media centre

10 December 2020

The latest data and insights from LCP’s Energy Analytics team predicts energy pricing to increase markedly over the winter months in Western Europe as European markets emerge from the latest Covid-19 restrictions. The latest findings come as Europe saw significant falls in demand and pricing through November during the latest lockdowns.

Harnessing LCP’s energy analytics tool, Enact, the team is predicting energy demand and prices to bounce back to usual winter levels as Europe eases out of lockdown and vaccinations begin to be rolled out. With Western Europe imposing the strictest lockdowns on average, prices have been most depressed and are expected to rebound the most.

Analysis of the pricing movements following the end of the first lockdown in August saw prices in Great Britain increase by 50% from the low levels experienced in April. LCP expects to see a similar but less stark trend to emerge as Europe recovers from November’s lockdown.

Rajiv Gogna, Partner, LCP Energy Analytics said: “We expect an increase in price across the continent, driven by rising demand as countries begin to exit lockdown and the drop in temperature. As restrictions loosen to varying extents, we expect price rises to vary from country to country, creating plenty of opportunities for traders.

“It’s not as simple as looking at demand recovery though. There have been tighter margins and increased volatility as we approach this winter relative to last year. The first week of December has been particularly volatile, largely driven by unusually low wind and dropping temperatures across the continent, and has already seen power being traded at over £1,000/MWh in Great Britain, and over €2,000/MWh in Belgium. We are expecting an expensive winter as these margins get tighter.

“Brexit will add to volatility and uncertainty as the ongoing negotiations mean the future trading arrangements between the UK and Europe remain uncertain. Without a clear deal, the de facto position is a decoupling of the two markets and separation of the exchanges used to trade power, which will lead to sub-optimal market outcomes and ultimately higher prices for consumers.”

Lockdowns hit pricing and demand in November

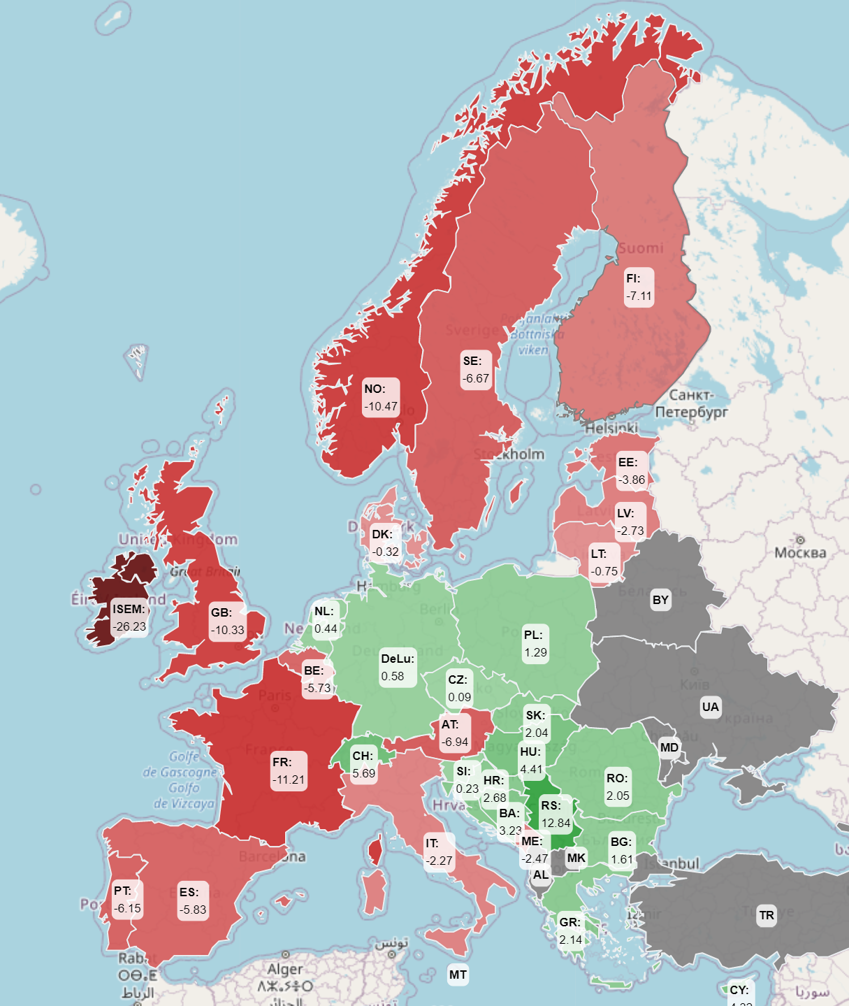

LCP Enact highlights how national lockdowns severely impacted energy demand and how this pushed down prices in November compared to the same period last year, both directly through lower demand and indirectly through lower gas prices. Ireland, with the strictest measures, experienced a 26% fall in demand as well as a 15% drop in pricing. Other countries with strict lockdowns exhibited substantial drops in demand as well, such as Great Britain, Norway (both over 10%) and France (over 11%).

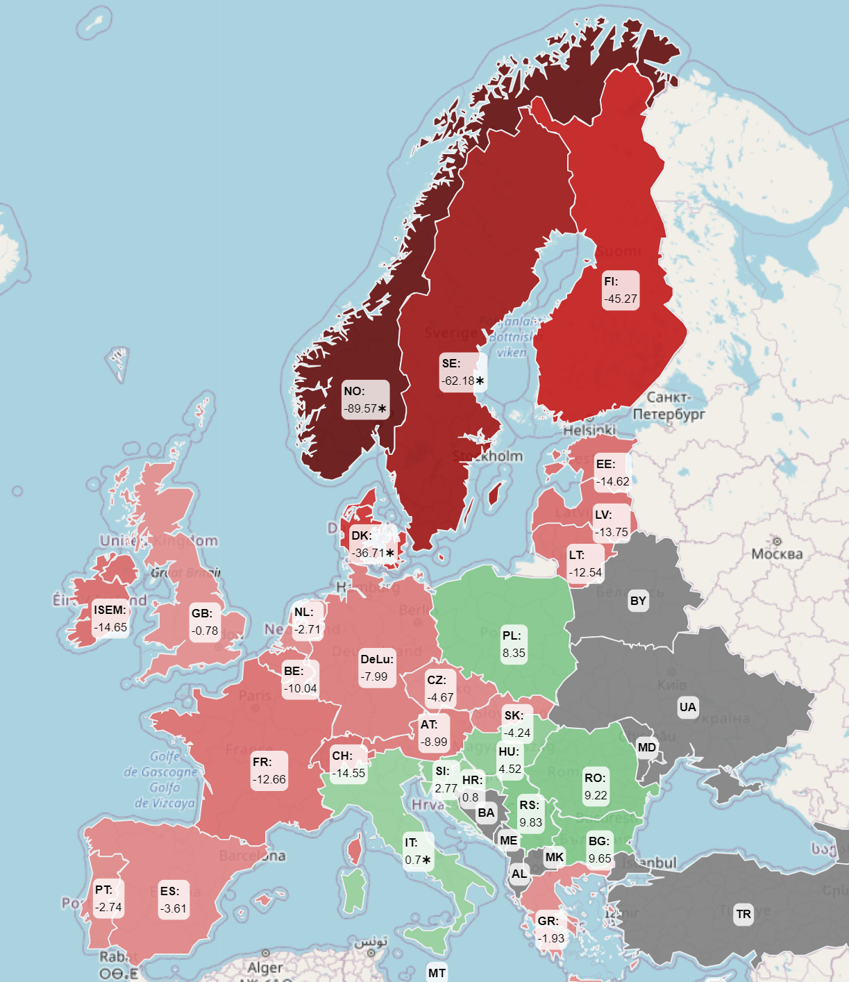

Scandinavian countries entered last month with high levels at their hydro reservoirs due to a warm winter and high rainfall last year, and coupled with lower demand due to Covid restrictions in November, this resulted in up to a 90% decrease in the day ahead price of electricity compared to November 2019.

Table 1: Top ten European countries with significant drops in demand comparing November 2020 to November 2019

| Country | Demand | Prices |

| Ireland | -26% | -15% |

| France | -11% | -13% |

| Great Britain | -10% | -1% |

| Norway | -10% | -90% |

| Sweden | -7% | -62% |

| Austria | -7% | -9% |

| Finland | -7% | -45% |

| Spain | -6% | -4% |

| Portugal | -6% | -3% |

| Belgium | -6% | -10% |

November also saw significant differences in the volatility of key markets. Although France exhibited a 10% fall in average price over November 2020 compared to November 2019, volatility remained broadly stable due to the country’s high reliance on nuclear technology, with the decline largely attributable to falling gas prices. Great Britain, however, has seen a relatively small price decrease but a significant uptick in volatility, due to tighter margins and the fluctuating levels of energy generated through wind. Particularly in winter, it is crucial that traders have a deep understanding of the dynamics of a market’s generation mix and its routes to stabilising prices. Each country has varying levels of intermittency, demand profiles and connectivity to adjacent countries which all play a key role in the volatility of pricing.

The latest analysis comes as LCP Enact has expanded the amount of data available to energy traders with over 35 European counties now being included in the platform, along with new analytic tools for monitoring National Grid’s ancillary services.

Average demand change by country (%): November 2020 compared to November 2019

Kyle Martin, Head of Market Insight at LCP, commented: “This is an important step for the Enact platform. The integration of European data allows users to monitor hundreds of metrics from over 35 countries. With European power prices increasingly influenced by neighbouring countries, it is vital that traders can easily access, compare and analyse information for the whole of Europe if they are to deploy a successful trading strategy.”

The data can now also be accessed on The Energy Current, a free, interactive website enabling users to better visualise Great Britain’s power market in real time and compare pricing across Europe.

Average day ahead price change(%): November 2020 compared to November 2019

By pulling data sources from Europe, LCP Enact is now able to present a wider range of data, allowing traders to make more informed decisions on how to trade their power. Traders can quickly visualise market data from different countries over the course of a day as well as compare multiple countries at once, set up notifications for European countries and access interconnector flows across countries to better understand how cross-border products will be traded. The new market data available across European counties includes:

- Day ahead prices

- Imbalance Prices

- Imbalance volume

- Generation forecasts

- Wind forecast

- Solar forecasts

- Demand forecast

Enact also provides analytics on all National Grid ancillary services including the new Dynamic Containment frequency product, STOR, FFR and reserve, as well as the Capacity Market. The combination of these functionalities allows traders to look at the value across markets and countries, and make informed decisions about which markets to participate in.