LCP responds to

High Court judgment on women's state pension age

Media centre

3 October 2019

Commenting on the High Court judgment in relation to the case brought by the campaign group Back to 60, David Everett, LCP Partner and Head of Pensions Research says:

“Whatever the rights and wrongs of this case, there is little doubt that many 1950’s-born women were unaware and unprepared for what for some is a substantial increase in the age at which they can draw their State Pension.

There are two hindsight lessons to draw from this:

- First, there could have been far better communication, targeted at those most affected, when the changes to the State Pension were made – and any such communication should have been ongoing;

- Second, the transition ought to have been gentler so that the shock was less for those caught unaware.

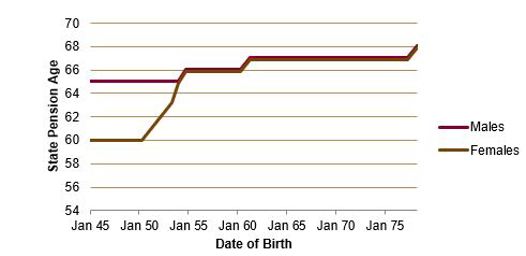

The chart below demonstrates the steepness of the change, with later increases in State Pension Age for both sexes also illustrated. One can make a case that the equalisation change should have come sooner but been staggered. Arguably, the mistake made by John Major’s Government, nearly 20 years ago now, was to put in place a very steep equalisation timetable that didn’t start to kick in until 2010 – some 13 years after he left office. And the limited communication meant that many of those most affected assumed that the long-standing State Pension Age of 60 for women and 65 for men would continue.”

The State Pension is a big thing. It is the bedrock of retirement income and for many is by far the biggest element of their retirement provision. So changes to it and particularly to when it starts have to be communicated carefully and effectively.

But when you ‘join’ this pension scheme on turning 16, no-one informs you of this fact. As you build up your NI record, no-one tells you how you are doing. In fact, you have absolutely no idea about your State Pension entitlement until you get close to State Pension Age by which time it is too late.

This is in contrast with the disclosures that successive Governments have rightly required occupational pension schemes to make to their members. So long as the occupational pension scheme remains properly resourced, well-run and can stay in contact with its members, there should be no surprises when each member comes to draw his or her retirement income from it. And that is how it should be.”